Lessons Learned by a Patient Investor

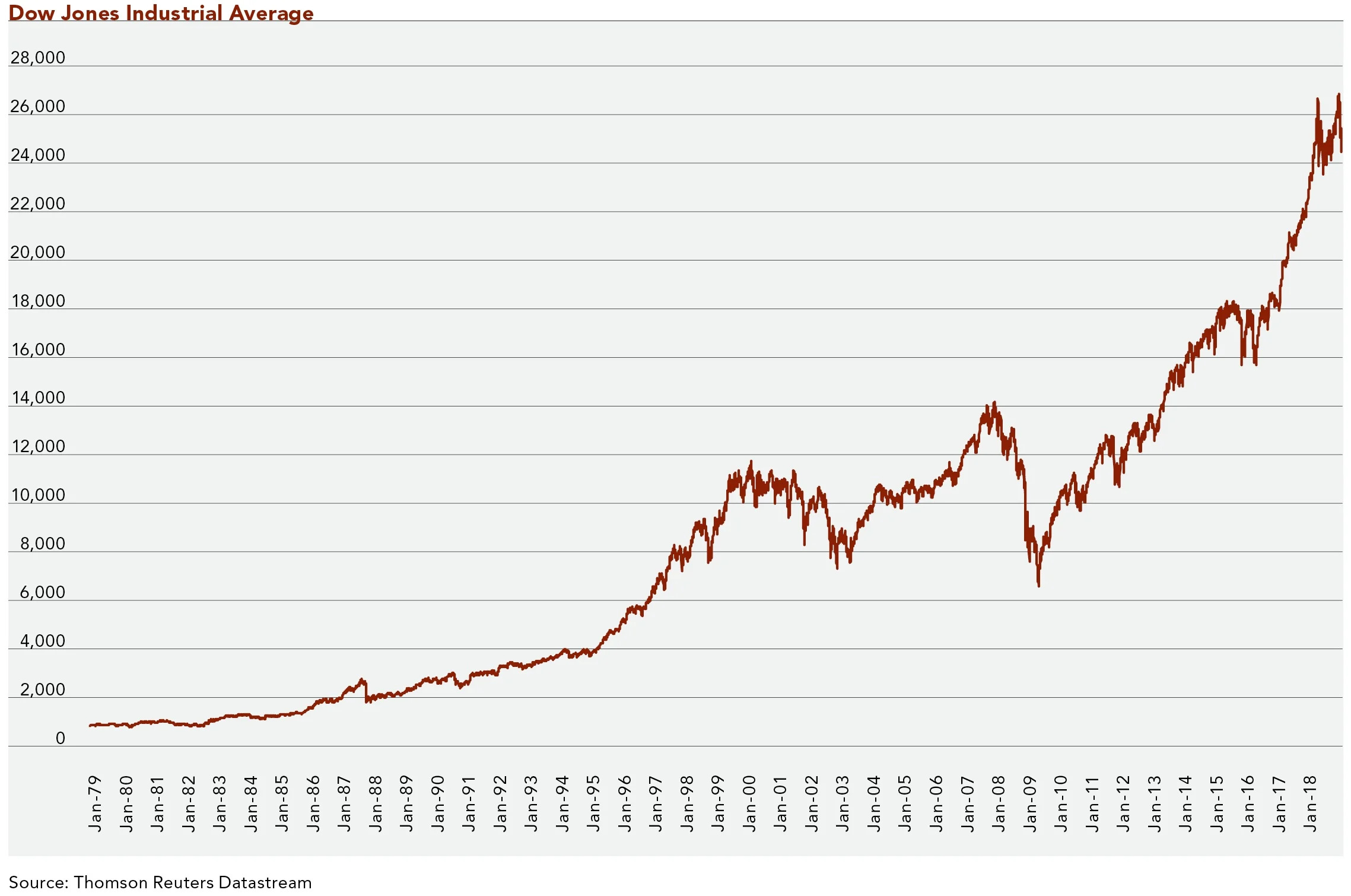

I began my investment counseling career in 1979. The Dow Jones Industrial Average (DJIA) ranged between a low of 797 and a high of 897 that year (the DJIA is currently trading around the 24,000 to 25,000 level). I recall the euphoria investors felt when the index crossed 1,000 in November 1980, for the first time since 1972. It quickly retreated and did not sustain levels above 1,000 until three years later. The index did not surpass 2,000 until 1987.

“When I started working in this field, the everyday mechanics were very different from today.”

When I started working in this field, the everyday mechanics were very different from today. No one had a desktop computer. The big excitement in my office was when we got an IBM Selectric typewriter, with autocorrect! Another tool was a ten-key adding machine, and I became proficient on that. We didn’t have the internet, so we watched the tape on a small black and white TV, set to a financial channel. We couldn’t trade electronically; we called brokers to place trades for our clients. We didn’t have the option of using portfolio management software for record keeping and reporting to clients. Instead, our clients’ trading records were kept by hand, backed up by paper copies of custodial statements and trade confirmations. When I first started, we didn’t even have a fax machine.

In spite of these limitations, our firm conscientiously invested our clients’ portfolios in high-quality stocks and bonds. We did our own research, reading company filings, and we also subscribed to third-party research. We had our own method for determining which stocks were undervalued or overvalued, and used a Texas Instruments financial calculator (which was state of the art) to execute our valuation formulas. We were a small shop, and the universe of stocks we followed was limited to about 40 companies. We analyzed each of those companies in depth. We understood their management teams, financial statements, product lines, and the opportunities and impediments faced by each firm that we followed.

We paid close attention to asset allocation for our clients. We were aware of studies showing that asset allocation is a significant component of investment returns. We also used asset allocation decisions to help manage risk, using the bond component of the portfolio holdings to provide income and stability, reducing the volatility of returns. We selected individual bonds using printed bond guides, which were updated quarterly. We also had relationships with brokers who helped us find good quality municipal bonds for our clients’ taxable portfolios. We were careful to diversify the bond holdings as well as the stock positions in each portfolio.

“These investment principles should be familiar to our Clifford Swan clients because we follow the same philosophy today.”

These investment principles should be familiar to our Clifford Swan clients because we follow the same philosophy today. We have more tools, more speed, more information, and a greater capacity to follow more stocks. However, we still aim to know our companies well, and we still construct our clients’ portfolios stock-by-stock and bond-by-bond. We pay close attention to asset allocation and diversification.

In the early 1980s, one of our clients (a retired engineer) bought a personal computer. He became a computer enthusiast and volunteered to run our stock valuations for us. Each Friday, I would call him and read a list of the closing prices for the stocks we followed. He fed them into his program and mailed us the printed results. Eventually, this process sped up when we both got fax machines!

Our technology evolved. We started using an outside service that provided portfolio management software. We eventually acquired personal computers and learned to use the Microsoft Office suite of programs, including Excel, Word, Access, and PowerPoint. While these tools made our work more efficient and convenient, they did not change the fundamental aspects of the investing decisions we made on behalf of our clients. We did not change our low-turnover practice by trading more often. We continued to focus on the long term and on the quality of our clients’ holdings.

During the early 1980s, the DJIA went from 824 in January 1983 to a high of 2,740 in August 1987 and seemed to be headed on a steadily upward path. We all got a big shock in October 1987. On Friday, October 16th, the DJIA fell 108 points on record volume. The carnage continued on the following Monday, referred to as Black Monday, when the index fell 508 points, a 22% decline. That is still the largest one-day percentage decline on record. The DJIA fell by 26% in just two days. The rapid decline and record volume was unprecedented in our lifetimes. There didn’t seem to be any fundamental cause for this event. Reading later about the cause of the swift, unchecked selloff, we learned two new terms: “portfolio insurance” and “program trading.”

“Portfolio insurance” was a new product, used by large institutional investors with the goal of protecting investors when the market declined. The plan was that when stocks declined by a certain percentage, the “insurance” would kick in and automatically sell the declining stocks. This type of transaction was only possible due to “program trading” whereby a computer program took over and placed trades without human intervention, according to pre-determined instructions. The “insurance” backfired. As the market declined, the program sold stocks, which led to more declines, which led to more sales. It was emotionally devastating for those of us helplessly watching the market crater. It seemed that nearly all stocks declined together, without regard to quality or earnings. The baby and bathwater went out together. It shook our core understanding of how the market should behave. Still, we did not panic; we did not sell.

Fortunately, the decline was short-lived, although the market remained volatile for the rest of the year. We felt tremendous relief as the index recovered. By the middle of 1988, the DJIA was holding above 2,000 again. We had learned about the new reality that computing power brought to the market. The convenience and speed of using computers to make transactions was definitely a double-edged sword. On the one hand, this type of trading improved liquidity, lowered trading costs, and narrowed the spread between bid and ask prices (the bid is the price a buyer is willing to pay; the ask is the price the seller wants to receive). On the other hand, computer trading increased the likelihood of market volatility, due to high volume trading at lightening speeds, and the potential for major meltdowns.

“The convenience and speed of using computers to make transactions was definitely a double-edged sword.”

Since 1987, investors have lived through a number of market events, including the Dot-Com bubble bursting in 2000 (which impacted the technology stocks traded on the NASDAQ much more than the DJIA stocks). More recently, the Flash Crash in 2010, Taper Tantrum in 2013, and Brexit in 2016 all led to brief but dramatic declines in the index. The 2008 financial crisis was different from all of these market events because it was caused by an underlying economic crisis, not just a market event. Excessive leverage had permeated the world’s financial markets. In the early 2000’s U.S. real estate prices were riding high on easy money and lenient lending standards. Many home owners came to believe that housing prices would always go up, and they borrowed accordingly. When the asset bubble burst, the leverage was exposed and the interconnectedness of our markets meant that the entire global financial system was under threat of collapse. We were on the brink of another Great Depression like the one in the 1930s, and that fate was only avoided due to major invention by the world’s governments. One can debate the benefits or harm of the methods used, but something had to be done, and quickly, to save the financial system and the general economy.

“The lessons learned in 1987 still apply for investors today.”

The lessons learned in 1987 still apply for investors today. Your investment counselor will work to build a well-constructed portfolio, designed to meet your financial goals and objectives, paying attention to asset allocation and diversification, and focusing on the long term. These are the principles that Clifford Swan’s founders taught us, and they continue to form the foundation of our work for our clients.

“Now we have new lessons, too. Expect the unexpected. Accept that there will be shocks, and periods of volatility.”

Now we have new lessons, too. Expect the unexpected. Accept that there will be shocks, and periods of volatility. With the market trading in the 24,000 to 25,000 range, pay attention to percentage changes in the index, not just the raw numbers. Be skeptical of headlines, such as the ones that recently declared “Dow Plunges 600 Points,” followed by “Dow Surges 500 Points.” The “plunge” was a 2.4% decline and the “surge” was a 2.1% gain. Remind yourself that headline writers are looking for drama, to grab the reader’s attention.

“A correction provides investment opportunities. A crisis may require intervention.”

Don’t expect the market to steadily climb forever. Don’t be lulled by the gently rocking cradle of stock market stability. Try to understand and remember the difference between a normal market correction and an actual crisis. A correction provides investment opportunities. A crisis may require intervention. The patient investor, who does not panic, has, historically, been rewarded by the market.

Carolyn Barber is retiring at the end of this year. After 22 years working with clients at Clifford Swan, she is looking forward to the next stage in her life, joining her husband in retirement. They plan to stay in Altadena, and to enjoy the cultural opportunities available in the Los Angeles area, including the many fine art and science museums that they have not had time to visit while working. They also plan to travel more often, and will continue to explore the great outdoors, including visiting more of our country’s wonderful National Parks. At home, they will enjoy gardening, yoga, watching Dodgers baseball, and goofing off!

Source: Historical market data obtained from Bloomberg.

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.