Alternative Investments: What Are They and Do They Belong in Your Portfolio?

Many investors have seen or heard periodic ads for alternative investments or read about them in various business and investment sources. The natural questions are: What exactly are alternatives, and do they belong in my portfolio? These are specialized investments, and while they have some attractive qualities and can serve a valuable role in an overall investment portfolio, they are not for everyone.

<br>

WHAT ARE ALTERNATIVE INVESTMENTS?

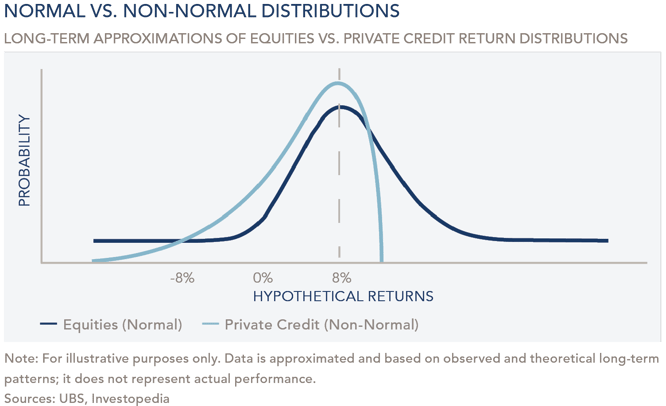

Basically, alternatives are any investment outside of traditional asset classes. Traditional assets include stocks, bonds, and cash. Returns on these conventional investments will have fairly predictable return ranges (in statistical jargon, they have assumed normal distributions with a bell shape representing historical outcomes). Alternatives encompass everything else, including real estate, commodities, private equity, private credit, hedge funds, farmland, and intellectual property.

<br>

ROLE OF ALTERNATIVES IN A PORTFOLIO

Traditional assets (stocks, bonds, cash) are the basic building blocks we utilize within an investment portfolio, especially looking to stocks for growth and return. Under typical financial conditions and in normal market cycles, stocks and bonds tend to move in opposite directions. When stocks go up, bond prices may go down; alternatively, when stocks go down, bond prices go up. That is, they tend to counterbalance each other within a portfolio, usually smoothing out the portfolio’s performance by minimizing the very high swings up and the very low swings down, making the whole portfolio less volatile. In addition, some investors may add small capitalization or international stocks to increase the potential for higher returns. Maintaining higher cash levels can also further diversify a portfolio. Notably, 2022 was an unusual year when both stock and bond prices went down.

Alternative investments may be used as a diversifier and to enhance both income and total return. However, investors would need to accept that the return on alternative investments is non-normal; that is, the spread or distribution of the returns are not symmetrical like those of stocks and bonds and may have extreme ranges.

<br>

TYPES OF ALTERNATIVE INVESTMENTS

Real estate has been used in investment portfolios for several generations, typically providing both income – from charging rents for the use of physical space – and appreciation from the value of tangible property going up. The other options, such as real estate financing, are less familiar.

Commodities are investments in many of the materials and metals used in production (e.g., iron ore and copper), and in metals used as stores of wealth (e.g., gold and silver).

Private equity typically (but not exclusively) represents ownership in start-up or early-stage companies that do not trade on public stock exchanges, such as the New York Stock Exchange. A private party provides capital to a small company, for example, with the expectation of selling the company in conjunction with it going public. Many of today’s publicly traded companies started this way.

Similarly, private credit is when a non-bank entity (such as an individual or limited partnership with investable cash) provides loans and credit outside of traditional funding sources (such as banks and finance companies). Interest rates are usually higher than the traditional funding sources.

Hedge funds are basically investment pools (limited partnerships) that have specific objectives and a lot of leeway to make investments. It could be a fund focused on preferred stocks or convertible bonds, or on investing in various companies that are merging. Other funds might invest in currencies (e.g., British pound sterling, U.S. dollar, euro, Japanese yen) or in a pool of non-investment grade bonds and assorted bond structures (subordinated, senior, etc.). Others may make investments based on global trends and dynamics, shifting assets from different financial areas and different countries to other countries or asset types. Some purchase a significant minority stake in a publicly traded company to change how it is run as an activist investor. Overall, a wide diversity of strategies is utilized by hedge funds with the best ones typically having a consistent focus and identity.

Finally, there is a general miscellaneous group that includes farmland and timberland (e.g., Iowa corn fields and Oregon pine forests), as well as intellectual property such as a songwriter’s portfolio of music (for example, Michael Jackson bought the rights and royalties to The Beatles’ music).

There are also funds of these alternative assets, known as a fund of hedge funds, that invest in the various types of these investments to provide a broad portfolio of alternative investments. The fund could, for example, include private credit, private equity, commodities, and hedge funds, all in one aggregate pool of assets.

<br>

KEEP THESE QUALITIES IN MIND

There are special considerations with respect to alternative investments. These include reduced liquidity (ability to sell quickly), higher management fees, minimum investment sizes (e.g., minimum $100,000), and an extensive due diligence review of managers, structure, accounting, operations, and other key factors. Due diligence reviews help make sure that everything is operating above board and transparently.

“Investors would need a higher tolerance for risks (of various types), acceptance of more limited liquidity, and patience as some alternative assets have long life cycles.”

As a result of these unique aspects, alternatives are not for everyone. Investors would need a higher tolerance for risks (of various types), acceptance of more limited liquidity, and patience as some alternative assets have long life cycles.

<br>

ALTERNATIVES WE INVEST IN

Clifford Swan has historically offered alternative investments in instances when we think they can be helpful to a client’s goals. We primarily look to alternatives to limit the potential downside when added to a typical stocks/bonds/cash portfolio by reducing correlations between asset classes and dampening overall volatility. Specific investments include real estate – including single property ownership and pooled investments through limited partnerships – as well as liquid commodities funds, namely those focused on precious metals. Even so, alternatives require a cautious approach. We favor assets that are conducive to fundamental analysis (e.g., real estate and private equity) or have a long history from which we derive comfort (e.g., gold and silver). In considering external managers to work with, we have exacting standards, typically looking at those with a track record of investment style discipline, a repeatable process, and strong accounting and operational systems.

Alternatives are not for everybody, but they could make sense if approached in a thoughtful way with an appreciation for the risks. Your investment counselor would be happy to discuss this asset class with you in the context of your financial goals.

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.