June 19, 2017

WHAT IS ASSET ALLOCATION?

Simply put, it is the strategic mix of asset classes in a portfolio. The universe of assets in which to invest is broad and the risk spectrum ranges from ultra-safe U.S. Treasuries to high-risk Emerging Market stocks. There is a distinct tradeoff between risk and return. Riskier assets have the potential to provide higher levels of returns, but at higher levels of return variability. The chart below shows some of the risk/return tradeoffs of various asset classes, with standard deviation used as the measure of risk. Standard deviation indicates how dispersed a data point is from its average. A low standard deviation means that data points are scattered relatively close to their average (lower risk); conversely, a high standard deviation means that data points are scattered relatively farther away from their average (higher risk). Assuming that data points are randomly distributed in a normal way, one standard deviation denotes the probability that a data point will fall within a range of its average plus or minus its standard deviation 68% of the time.

As the chart above illustrates, U.S. Treasuries provided an average return of 1.39% with a standard deviation of 0.75%. Developed Market International Stocks provided a similar average return to U.S. Treasuries of 1.53%; however, its much higher standard deviation of 18.66% means that there was a much broader range of returns. As you can see, for this 10-year period one could get almost the same return of just over 1% on U.S. Treasuries for a much narrower range of variability (lower risk) compared with Developed Market International Stocks (higher risk).

There are many ways to gain exposure to an asset class. Among the variety of vehicles that can be used are individual securities, such as stocks and bonds, as well as mutual funds and exchange-traded funds (ETFs). The latter two are essentially pooled investments of individual securities. For instance, one can gain exposure to stocks, whether they are domestic U.S. stocks or international stocks, through individual securities, mutual funds, or ETFs. One can access the Real Estate asset class through real estate investment trusts (REITs), limited partnerships (LPs) or physical real estate properties. The vehicles through which one gains exposure to these asset classes can be passive (indexes accessed through ETFs) or active (individual securities). We here at Clifford Swan espouse an active approach to investing. Security selection within an asset class is in and of itself a broad topic and beyond the scope of this article.

Determining the asset classes in which to invest and the exposure levels to those asset classes is largely influenced by each investor’s unique circumstances and situations. While one might have encountered the general advice that one should allocate one’s age to bonds (e.g. a 40-year old ought to have 40% allocated to bonds), this view is too simplistic. While one’s age (something that is often referred to in investment terms as “time horizon”) can be one of the determinants of asset allocation, it alone cannot wholly dictate it. For instance, goals-based factors are also important when determining one’s asset allocation. Funds earmarked for shorter-term goals such as home purchases and vacations should be exposed to less risk while funds earmarked for longer-term goals such as college tuition and retirement can withstand relatively more risk. Additionally, some investors may wish to leave a legacy for their heirs while others may have specific philanthropic goals in mind.

Liquidity is also an essential factor. In addition to the general rule of keeping three to six months of living expenses as a cash reserve, one’s liquidity or cash needs, in conjunction with the goals-based factors mentioned above, are important determinants of asset allocation. Those who are still working have fewer liquidity needs than those who are retired. Some retirees who are actively withdrawing from their portfolios often cannot afford the higher variability of stock returns and may need more of the income stability that bonds can provide. However, there are no cookie cutter solutions to asset allocation. For example, more affluent retirees who do not need to make income withdrawals may wish to grow their portfolios as a legacy for future generations; their portfolios would be able to withstand higher risk.

Income tax considerations can be an element to consider when choosing asset classes. As an example, those in higher tax brackets will wish to maximize allocations to tax-free municipal bonds relative to taxable bonds in their taxable accounts.

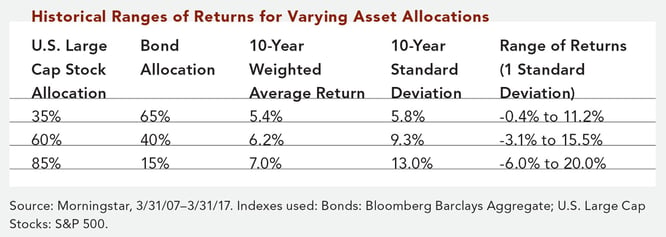

One’s ability to tolerate risk is also important. Each individual’s temperament is different. Nervous Nellies and optimistic Pollyannas will react differently to market downturns; some may be able to withstand more variation in their investments than others. In general, one would expect to be compensated with relatively higher returns in exchange for the ability to stomach higher variability of returns. In a basic two asset portfolio invested in U.S. Large Cap Stocks and Bonds, simply varying the allocations to each asset produces different risk/return profiles as shown in the table below.

Although past performance is no guarantee of future results, as you can see, historically, increasing one’s allocation to the riskier asset (U.S. Large Cap stocks) resulted in higher returns. At the same time, doing so also resulted in a wider range of returns due to higher standard deviations.

Ideally, one’s asset allocation should be customized to reflect one’s distinctive situation as the optimal path to reach one’s specific financial goals with the appropriate amount of variability (volatility).

WHY IS ASSET ALLOCATION IMPORTANT?

How one allocates investments among different asset class choices will determine the variability of one’s portfolio returns. While a higher allocation to riskier assets may result in higher returns relative to lower risk assets, it will also result in higher return variability. As one nears the end of one’s time horizon or is close to achieving a specific financial goal such as retirement, one should be mindful that lower return variability may be favored as the need for stability and asset preservation outweighs the need to grow assets. Similarly, the mere uncertainty of life events can also warrant lower return variability, as unforeseen liabilities due to job loss or major illness can occur. Lower return variability lowers the likelihood of having to sell from an asset class at an inopportune time (e.g. when an asset class is experiencing a downswing). It is up to each individual to balance the preference for higher returns with the ability to tolerate the higher variability in returns intrinsic to riskier assets. Ultimately, one’s portfolio’s asset allocation should be customized to reflect one’s distinctive financial profile and should be diversified in order to minimize return variability over time.

DON’T PUT ALL OF YOUR EGGS IN ONE BASKET

Diversification of assets among a variety of asset classes can be helpful over the long term as asset class returns vary over time. Individual asset classes move up and down in different amounts at different times. The measure of how two assets move in relation to each other is called correlation. One simple example of this would be investing in umbrellas and beach balls. Umbrellas are basically a foul weather item while beach balls are a fair weather item. One would expect the demand for these items to move in opposite directions, or in a negatively correlated way.

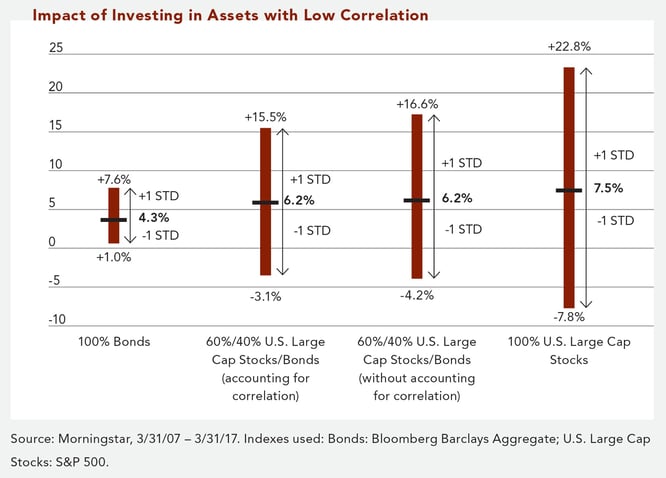

When one diversifies by investing in asset classes that have little to no correlation with each other, there are long-term benefits in the form of relatively lower overall return variability of the portfolio over time. For example, as shown in the chart below, a portfolio invested 100% in U.S. Large Cap Stocks would have returned on average 7.5% with a standard deviation of plus or minus 15.3% over the 10-year period ending 3/31/2017 (that means returns could have varied from -7.8% to +22.8%). Likewise, a portfolio invested 100% in Bonds would have returned on average 4.3% with a standard deviation of 3.3% (a return range of +1.0% to +7.6%) over the same time period. A portfolio weighted 60% in U.S. Large Cap Stocks and 40% in Bonds would have returned a weighted average 6.2% over this time period. The standard deviation of this portfolio, however, is not simply the weighted average of respective standard deviations for U.S. Large Cap Stocks and Bonds (which would be plus or minus 10.4% or a range of -4.2 to +16.6%). Instead, the low correlation of 3% between U.S. Large Cap stocks and Bonds dampens the volatility of the overall portfolio, lowering the standard deviation to 9.3% or a narrower range of -3.1% to +15.5%. Investing in asset classes that aren’t correlated with each other increases portfolio diversification which can help mitigate risk over time.

IS ASSET ALLOCATION SOMETHING I CAN SET AND FORGET?

No. Over time market fluctuations result in asset class over- and under-weights relative to your original asset allocation and taking a disciplined approach of rebalancing to that original allocation may be in order. More importantly, life changes (marriage, family, retirement, death, etc.) will warrant revisiting your original asset allocation. We at Clifford Swan believe that it is essential to craft an asset allocation that reflects your own unique financial situation and stand ready to customize those allocations as your circumstances change.

Download Article: Back to Basics: Asset Allocation