Update: Charitable Gift Annuities More Attractive As Payout Rates Rise Again

Now is a good time for those wanting to give to consider establishing a charitable gift annuity. At its core, a CGA is an arrangement whereby assets are given to a charity in return for the charity’s promise to make lifetime payments of a fixed amount to a beneficiary, who is often the donor. This stable income stream makes CGAs a popular planned giving vehicle.

For two reasons, charitable gift annuities are increasingly attractive in 2023:

<br>

RISING PAYOUT RATES

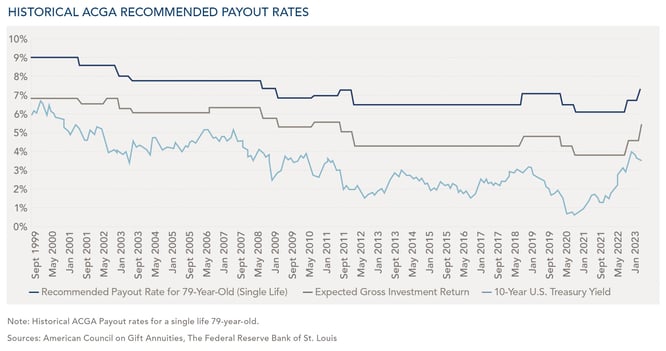

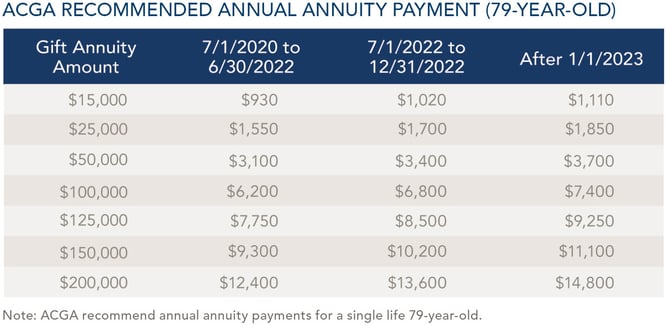

In August, we wrote about how payout rates for charitable gift annuities were rising along with interest rates. Starting January 1, 2023, the American Council on Gift Annuities (ACGA) once again increased its recommended maximum annuity rates, replacing the rates last updated on July 1, 2022. The sharp rise in interest rates in the second half of 2022 prompted the ACGA to increase its suggested CGA payout rates after just six months.

While the rates offered for an annuity vary based on the charity, most institutions follow the ACGA’s recommendations. The new recommended rates are the highest in over a decade.

“The new recommended rates are the highest in over a decade.”

<br>

FUND A CGA WITH IRA ASSETS

The SECURE 2.0 Act enacted at the end of 2022 includes a provision giving IRA owners at least 70.5 years old the option to make a one-time qualified charitable distribution (QCD) to fund a charitable gift annuity up to $50,000. Additionally, this amount can count toward the donor’s required minimum distribution.

This new opportunity supplements the other attractive qualities CGAs offer donors, notably a tax-free withdrawal which can go towards meeting your RMD. Remarkably, a donor can get these benefits and an income stream! In 2023, a QCD can let you access rising rates with the extra advantage of tax-free withdrawal from an IRA.

“In 2023, a QCD can let you access rising rates with the extra advantage of tax-free withdrawal from an IRA.”

The timeless qualities of charitable gift annuities make them a good fit for some donors. Higher payout rates and the new option to fund a charitable gift annuity with retirement assets make this philanthropic tool even more attractive. If you are looking for ways to give, we urge you to talk with your counselor about what gifting strategy is right for you.

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.