Stop the Inflation Swindle

As a key tenet of our mission at Clifford Swan is to preserve and grow our clients’ wealth, inflation protection is always on our minds. Recently, however, the topic has made national headlines, with the Consumer Price Index (CPI) for the year ended March 2022 rising 8.5% versus the previous year—the highest jump since 1981. A closer look at the data shows why the topic has captured so much attention. Several of the components inflating the most involve everyday purchases like “food at home,” up 22% year-over-year in February, or gasoline, up 47%.

In last quarter’s newsletter, my colleague Randy Zaharia covered some potential causes of inflation and ways to position portfolios accordingly. In this article, we focus on equities. Though stocks don’t offer guaranteed inflation protection, company analysis and disciplined stock selection can give the investor an opportunity to maintain or grow purchasing power in a variety of inflationary environments.

“…company analysis and disciplined stock selection can give the investor an opportunity to maintain or grow purchasing power in a variety of inflationary environments.”

In a 1977 Fortune article titled “How Inflation Swindles the Equity Investor,” Warren Buffett challenged the conventional wisdom that stocks are always a hedge against inflation. He looked at years of data across various inflationary and non-inflationary periods and found that, on average, return on equity (ROE)—the income generated relative to equity capital invested—was relatively stable for the market at around 12%, regardless of the inflationary backdrop. In other words, typically when sales see a boost from inflation, expenses and reinvestment requirements balloon as well, making it very difficult to benefit on the revenue line without taking a corresponding hit to the bottom line. Granted, ROE is not a perfect proxy for what an equity investor should earn over the long run. But since 12% is a fixed number, Buffett noted that stocks can look a lot like fixed income investments unless this “equity coupon” can grow. Moreover, for most investors, the “equity coupon” is pre-tax. Depending on how high tax rates and inflation are, real returns can be much lower.

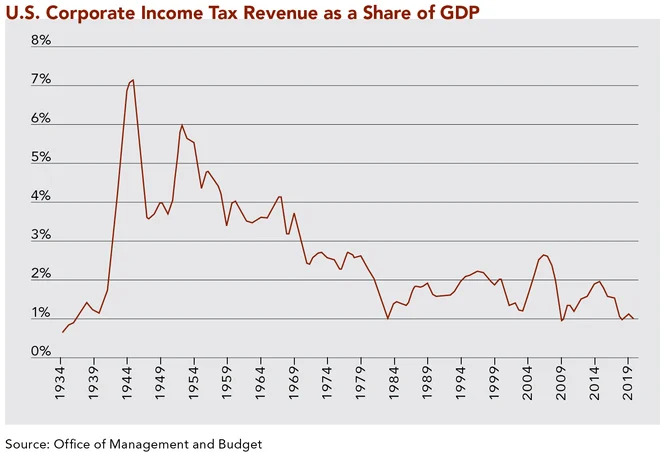

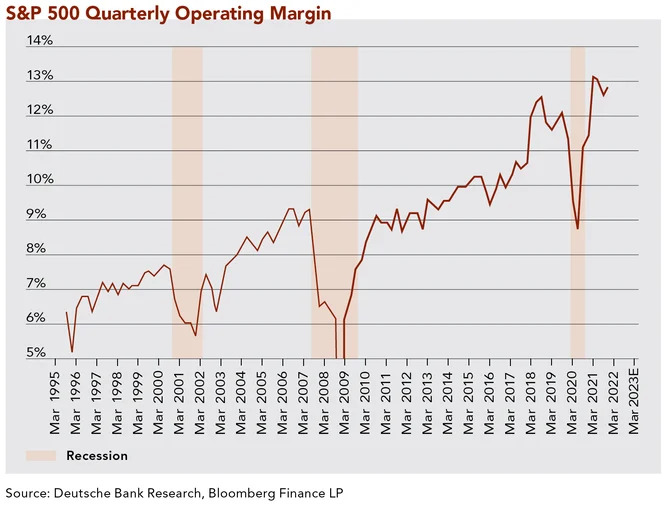

To combat such a mediocre real return scenario, Buffett describes actions company management can take to grow ROE. These include taking on more debt or cheaper debt, paying lower income taxes, increasing turnover (the ratio of sales to assets), or expanding profit margins. At the time of writing, Buffett argued that these actions were easier said than done. From our perspective, he’s as right today as he was in 1977. Taking on more debt will be too burdensome for many companies in the current environment, as inflation generally leads to higher interest rates and borrowing costs. Further, lower tax rates seem unlikely. Corporate income tax as a percent of GDP is near multi-decade lows [see the chart above], making it unwise to bet on tax rates falling from here. Next, corporate profit margins, which have tended to mean-revert over long periods, are near multidecade highs [see the chart below]. And finally, to create a higher ROE for shareholders via higher turnover, sales growth must outpace asset growth. Unfortunately, inflation of a company’s capital requirements makes it challenging to widen the ratio of sales to assets arising from an increase in revenue.

For the market as a whole, the current inflationary environment seems formidable when considering the likelihood of attractive real investment returns. However, looking on a firm-by-firm basis, it is possible to uncover businesses capable of mitigating the effects of inflation. Our stock selection process seeks out these types of companies in several ways. Through active management, equity portfolios can be positioned accordingly.

First, we keep a close eye on balance sheets. For the most stable companies with recurring revenues, sometimes more debt may be added to prudently boost ROE. For most companies, we don’t like to rely on more leverage to drive returns. We favor businesses with economics that are so attractive that management doesn’t need to borrow to fund operations or growth. If inflation leads to higher borrowing costs, it shouldn’t matter too much to our companies under coverage. We don’t find it to be a good use of time to forecast U.S. tax policy. However, some companies benefited from the Tax Cut and Jobs Act of 2017 more than others. For the ones that benefited the most, we are particularly cautious about assuming “lower for longer” tax rates. All else being equal, we prefer that the intrinsic value of our companies does not rely on generationally loose tax policy.

We spend significant time analyzing the final two sources of ROE growth—turnover and profit margins.

Management skill plays a key role in the growth or decline of these two factors. A major advantage the “equity coupon” has over a bond coupon is that the equity coupon can be retained and reinvested by management instead of being paid to the investor in cash. Diligence into how company leadership allocates these funds is critical. Investments in projects involving a new product or a new market might generate both higher turnover and wider margins. In contrast, missteps may lead to declining fundamentals, or worse. Management track records, incentives, and strategies for the future can be analyzed. We form views on which teams are most likely to succeed in a variety of macroeconomic conditions, inflation notwithstanding.

“A major advantage the “equity coupon” has over a bond coupon is that the equity coupon can be retained and reinvested by management instead of being paid to the investor in cash. Diligence into how company leadership allocates these funds is critical.”

Each company and industry has its own nuances. Addressable markets might be large, creating opportunities for higher turnover but also inviting more competition. Or, markets may be more niche, limiting potential turnover growth, but also keeping new entrants at bay and providing the opportunity for wider margins for incumbents. Some companies can raise prices faster than underlying expenses, and some cannot. Certain businesses can grow sales volumes without many corresponding fixed costs. Others cannot. We believe that analyzing fundamentals to determine potential sources of ROE improvement is time well spent.

Although recent headlines may raise eyebrows and invoke memories of 1970s-style inflation, there are ways to “stop the inflation swindle.” We believe that, over the long run, an investor can maintain and grow purchasing power through disciplined stock selection.

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.