May 11, 2023

Around the time of the Global Financial Crisis (GFC), a guest comedian on Late Night With Conan O’Brien poked fun at airline passengers who complained about boarding difficulties and tarmac delays. The comedian pointed out that if these passengers would just focus on what happened next – participating in the “miracle of human flight” – they might appreciate that a coast-to-coast flight in six hours is an impressive outcome despite some inconveniences along the way. The anecdote came at a time when the world needed a dose of optimism.

There are parallels to today’s investment backdrop. For more than a year, the mainstream media has been predicting that a recession is right around the corner. Results from the Bank of America Fund Manager Survey (FMS), which quantifies professional investors’ perception of risks to financial stability due to the business cycle, the credit cycle, geopolitics, and several other factors, have looked similar to 2008-2009 levels for the past year. Pessimism is alive and well. However, as much as a slowing economy may lead to delays on the runway in the short term, there are several structural reasons why we could be in for a pleasant flight over the long run.

"...there’s little doubt that we’re starting to see some economic softness."

As of the spring of 2023, there’s little doubt that we’re starting to see some economic softness. Recent earnings from companies exposed to interest-rate-sensitive areas of the economy like construction point to early signs of a slowdown. The retail and technology sectors have seen layoffs as customer demand has moderated. When it comes to the economy’s financial engine, rising interest rates have weakened the balance sheets of numerous banks, restricting their willingness and ability to lend. Granted, the country’s largest banks still appear healthy. Loan-loss provisions are rising, but they’re not yet near the levels seen during the Great Recession or the pandemic. Regardless, according to Citigroup CEO Jane Fraser: "It's now more likely that the U.S. will enter into a shallow recession later this year.” That logic seems sound to us.

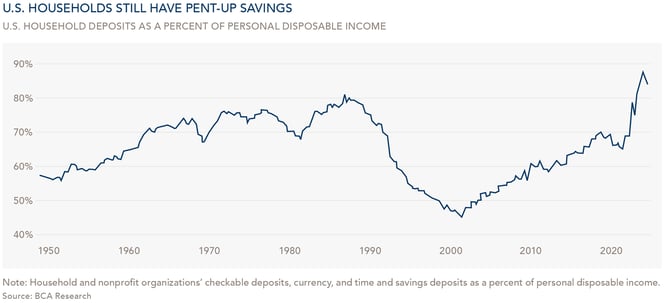

The resilient consumer could be a double-edged sword. Flush with cash from pandemic-driven stimulus, the average consumer may be able to withstand a sluggish economy for longer than usual (see the chart below). But there’s a chance this dynamic could simply delay the decrease in demand and resulting job market cooling necessary for the Federal Reserve to make monetary policy more accommodative. Accordingly, the uncertainty around when the next leg of the economic cycle will arrive could persist for some time.

And so despite the current environment lending itself to “more pessimism for longer,” the factors that brought us here – namely the pandemic and select stimulus initiatives – created some long-term structural tailwinds that we can look forward to as investors. Two of these in particular are the “re-shoring” of U.S. manufacturing production and the modernization of U.S. infrastructure. These themes stand to benefit the U.S. economy as a whole as their effects reverberate through multiple industries.

"...the factors that brought us here – namely the pandemic and select stimulus initiatives – created some long-term structural tailwinds..."

Re-shoring refers to U.S. businesses bringing production home, or at least preventing it from centralizing in regions with growing geopolitical risk. UBS Research compiled a list of 222 companies that have announced plans to expand their supply chains into the U.S. as of late last year, and it’s a who’s who of manufacturing leaders. Semiconductor titans Intel and Taiwan Semiconductor make the list. So do automobile manufacturers Toyota, Volkswagen, and Honda. Defense prime contractors Lockheed Martin, Northrup Grumman, and Raytheon Technologies are named. Perhaps the largest cohort is the general industrial companies that supply these firms, such as BASF, Panasonic, and Parker Hannifin. What began as a buzzword during the pandemic has evolved into what appears to be a sustainable trend.

While a case can be made that re-shoring may lead to higher manufacturing costs, negating any economic benefits, we’ve seen some recent arguments to the contrary. The International Economic Development Council found that as far back as 2010, the cost savings associated with off-shoring began to erode due to higher labor and transportation expenses as well as unforeseen costs in monitoring, quality control, and intellectual property protection. More recently, snarled supply chains disrupted the economy significantly toward the end of the pandemic. Re-shoring reduces the risk of that happening again. Further, advances in automation technology have reached the point where domestic manufacturing can be more cost-competitive with off-shore production despite the additional jobs domestic production will create. And finally, when it comes to those new jobs, there will likely be a multiplier effect across the economy. The Economic Policy Institute claims that for every manufacturing job brought back to the U.S., seven new jobs are created in other industries. Although the economy has many moving parts and no one knows the second and third order effects of re-shoring with certainty, hundreds of companies are voting with their feet.

"...U.S. re-shoring and infrastructure re-development may boost the economy incrementally in the coming years..."

The problems with U.S. infrastructure (e.g., roads, bridges, waterways, electrical grids) have been well-known for years, but several legislative initiatives may mean the cavalry is on the way. The Infrastructure Investment and Jobs Act (IIJA), signed by President Biden in November 2021, is finally beginning to work its way into state-level projects. The IIJA authorized $550 billion in incremental spending over five years, backloaded after 2026. California has reported $14 billion of transportation funding so far, on its way to a forecasted $42 billion. The Federal Highway Administration has allocated $60 billion in IIJA funds for roads and bridges across all 50 states this year. The CHIPS and Science Act, signed into law in August 2022, carves out $280 billion for domestic semiconductor manufacturing and R&D. Eight new semiconductor projects have already broken ground, largely in Arizona and Texas, totaling $100 billion in estimated total spend (though much of this will be funded privately). And the Inflation Reduction Act, also signed in August 2022, apportions $251 billion for energy infrastructure, $58 billion for manufacturing projects, and $23 billion for transportation and electric vehicle investments. From August through December of last year, over $40 billion of new grid-scale clean energy projects had been announced. Even though U.S. GDP measures in the trillions, these are large numbers when taken together. In addition to the jobs these initiatives may bring, suppliers into the industrial economy – many of them public companies – are eager to begin reaping the benefits.

"Lengthening our analytical horizon to where we can visualize what may happen coming out of a downturn further lowers our heart rates."

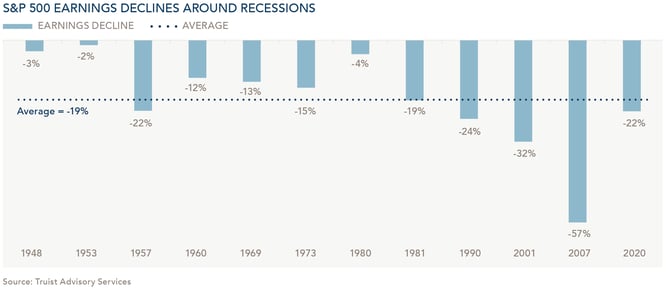

Although U.S. re-shoring and infrastructure re-development may boost the economy incrementally in the coming years, it’s still difficult to forecast the breadth and depth of the current slowdown. We note that the base case is that it won’t be as severe as the GFC, or even the pandemic-driven recession. Looking purely at S&P 500 earnings declines around the past 12 downturns, the average drop is 19%, which can be compared to the 22% decline during COVID and the 57% plunge during the financial crisis (see the chart below). For those of us invested in the U.S. economy, an average recession seems palatable versus the recent past. Lengthening our analytical horizon to where we can visualize what may happen coming out of a downturn further lowers our heart rates.

Importantly, a backdrop characterized by near-term weakness followed by long-term strength creates opportunities to find attractive investments. Market participants that don’t take a multi-year time horizon sometimes leave behind companies at attractive prices when viewed through the lens of long-term earnings potential. Our process at Clifford Swan is designed to take advantage of those opportunities on behalf of our clients.

Download Article: Market Update: Short-Term Pessimism, Long-Term Optimism

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.