December 13, 2016

The California Department of Insurance has changed the way gift annuity reserves are calculated. The required reserve for gift annuities received after 2016 will be based on the 2012 Individual Annuity Reserve Table and a 4% discount rate. This change will increase the required reserve for remaining life annuitants age 50 to 80 by 12% to 14% for females and 14% to 18% for males. At age 90, the reserve for females increases by 10% while the male reserve stays about the same. These increases only apply to gift annuities received after 2016; the required reserves for gift annuities held on 12/31/2016 are not affected by this change.

What is a Gift Annuity Reserve?

A gift anuity is created when a donor transfers assets to a charity in return for the charity’s promise to make future payments, often for a remaining life, to the donor or donor-designated beneficiary. The Department of Insurance regulates gift annuities in California. They require each charity to maintain a separate custody account with assets sufficient to make all future payments required by the gift annuities issued by the charity. The amount required to make all future payments is the state-required gift annuity reserve.

How Is the Gift Annuity Reserve Calculated and How Has It Changed in California?

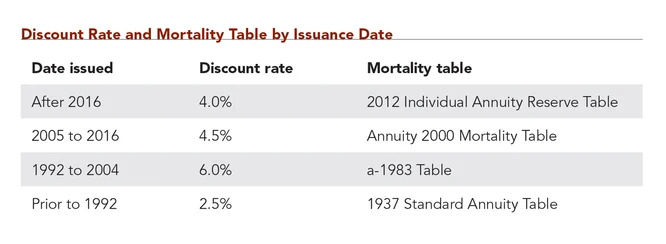

A gift annuity reserve at a point in time is the present value of the required future annuity payments. Aside from the amount of the annuity, the present value is determined by an assumed return on reserve investments (discount rate) and the expected duration of any remaining lives (mortality table). Both of these variables are prescribed by the Department of Insurance and depend on when the gift annuity was issued.

"A gift annuity reserve at a point in time is the present value of the required future annuity payments."

What Is Different About the 2012 Individual Annuity Reserve (2012 IAR) Table?

The 2012 IAR table is the first mortality table that adjusts each year for projected improvements in mortality. Created by the National Association of Insurance Commissioners (NAIC) from mortality data collected on owners of commercial annuities from 2000 to 2004, this dynamic “generational” table incorporates an improvement factor that is applied to each year following 2012. The result is an age-specific reserve that increases each year the reserve is calculated. For example, the 2027 California reserves based on the 2012 IAR mortality table will be greater than those calculated for 2017 by 1% to 3% for females and by 2% to 4% for males holding all other variables constant, including the age of the life annuitant and 4% discount rate.

"The 2012 IAR table is the first mortality table that adjusts each year for projected improvements in mortality."

How Are Gift Annuities Regulated?

Not all states regulate gift annuities, and those that regulate do so to varying degrees. About a third of the states do not require a gift annuity reserve or a minimum asset value. Another third requires that the charity maintain a minimum asset value regardless of the number of gift annuities issued. The remaining third requires that the charity maintain a reserve based on the gift annuities issued. About two-thirds of the states do not require an annual report from the charity on their gift annuity program.

"Not all states regulate gift annuities, and those that regulate do so to varying degrees."

California is considered a highly-regulated state that requires the charity to (1) register their gift annuity program prior to the issuance of any California gift annuities, (2) register all individual gift annuity contracts issued each quarter, (3) maintain a minimum reserve in a segregated account, (4) invest the reserves in accordance with certain asset mix guidelines, and (5) submit a detailed annual report on the activity of their gift annuity program and other issues. Only gift annuities paying California residents, when issued, are considered California gift annuities subject to these regulations. Gift annuities issued by a California charity paying a non-California resident are excluded.

California Segregated Account and Other Requiremens

The California Department of Insurance requires that a charity maintain its required reserves in a segregated account and any amounts in excess of the required reserve may be removed from the segregated account at any time upon a resolution by the charity’s board of directors. Furthermore, the charity is not required to put the full amount received for a gift annuity in the segregated account; only the reserve amount must be added to the account.

As an aside, given the ease and discretion of moving funds out of the segregated account, it is difficult to understand the need for a 13-page legal-size annual report with a 15-page instruction booklet and periodic debates over peripheral issues such as the inconsistent treatment of what expenses may be paid from the segregated account. Why not simply require proof that the segregated account is invested correctly (50% government-backed bonds) and that the minimum reserve value is met?

Whatever the state reporting and other requirements may be from time to time, it is our role at Clifford Swan to counsel our nonprofit clients on the technical and reporting requirements involved in administering their planned giving programs effectively.

Download Article: California-Required Gift Annuity Reserves Change in Assumptions