August 14, 2019

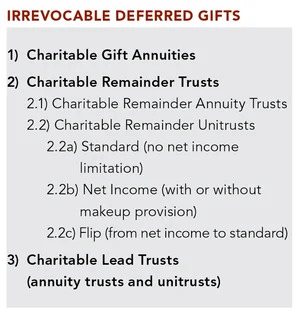

"Planned giving" is a broad term for charitable gifts made in conjunction with an individual’s financial or estate plan. These gifts are usually infrequent and relatively large. They can be outright gifts that are made available to the charity immediately, or they can be deferred to be used by the charity at a future date. Deferred gifts are a current decision to make a gift in the future and can be irrevocable, in the form of a gift annuity or charitable trust, or revocable, as in a will bequest or beneficiary designation in a life insurance or retirement plan.

As a donor’s uncertainty about his or her future financial needs and resources increases, the most appropriate form of gift generally moves from an outright gift to an irrevocable deferred gift, and finally to a revocable deferred gift. In all but an outright gift, the donor retains some right. The retained interest may be the right to periodic payments from a gift annuity or charitable remainder trust, or what remains when a charitable lead trust terminates. In a revocable gift, the donor retains the right to remove the charitable disposition in his or her will or change the charitable beneficiary in an insurance or retirement plan.

This article will focus on the intermediate stage of the planned giving continuum, irrevocable deferred giving. This includes various types of planned giving arrangements, each with unique characteristics that have evolved to address specific donor needs. A future article will address how the charitable deduction is calculated for each of these planned gifts and how the beneficiary (oftentimes, the donor) reports the payments he or she receives on a personal tax return.

1) Charitable Gift Annuities

Like annuity trusts, the periodic payments to the beneficiary are fixed and do not change over the life of the payments. Unlike annuity trusts, gift annuity payments are not subject to the availability of trust assets since the payments are a general obligation of the charity. For these reasons, gift annuities appeal to donors who are looking for certainty in the periodic payments they receive from the charity that assumes all the risk inherent in these life-term payment obligations.

Unlike annuity trusts and unitrusts, charitable gift annuities do not require a trust agreement or trustee. Reporting to the beneficiary on the taxability of the payments he or she receives does not involve annual calculations incorporating the types and timing of the income earned by the underlying investments. In addition, there are no annual tax returns that must be filed. Overall, the cost of creating and administering a charitable gift annuity is significantly less than other types of planned gifts, making charitable gift annuities most appropriate for smaller and more frequent giving.

2) Charitable Remainder Trusts

In a charitable remainder trust, the periodic beneficiary distributions (income interest) are made to a non-charitable beneficiary, and whatever remains in the trust upon its termination (remainder interest) goes to charity. The beneficiary payments can be fixed in amount, as in a charitable remainder annuity trust, or vary each year based on the trust’s market value, as in a charitable remainder unitrust.

A charitable remainder trust is a separate legal entity created by the transfer of assets to a trust governed by the terms of a trust agreement that is administered by a trustee. Annual trust tax returns are required that produce a K–1 for the beneficiary income reporting based on the type and timing of the trust income. Due to the administrative burden of a charitable remainder trust, these types of arrangements typically involve larger, less frequent gifts than a charitable gift annuity.

2.1) Charitable Remainder Annuity Trusts

Periodic beneficiary distributions of a fixed amount are made from a charitable remainder annuity trust. Like gift annuities, the fixed nature of the beneficiary distributions appeal to donors looking for predictability. Unlike gift annuities, the charity is protected since the obligation to make the beneficiary distributions only continues as long as there are sufficient assets in the trust to make the payments. Unlike unitrusts, the beneficiary distributions will not increase as the trust grows nor will they decrease if the trust assets decline in value.

2.2) Charitable Remainder Unitrusts

Additional contributions may be made to a unitrust but not an annuity trust. A unitrust is therefore the only trust arrangement for donors who intend to make additional gifts of the same type and want to avoid creating additional trusts.

Unlike gift annuities and annuity trusts, the amount paid to unitrust beneficiaries changes each year based on the change in the value of the trust assets. Unitrust beneficiaries share in any appreciation of trust assets since their distributions will increase in conjunction with the value of the underlying trust investments. Conversely, the beneficiaries share the investment risk with the charitable remainder since the beneficiary distributions will decline if the value of the trust assets decline. Donors who are able to accept this uncertainty in the amount distributed to the beneficiaries yet appreciate the long-term potential of increased distributions find unitrusts appealing.

There are three basic types of unitrusts, each designed to accommodate unique donor situations; standard, net income, and flip unitrusts.

2.2A) Standard Unitrusts

A standard unitrust makes periodic payments to an income beneficiary based on a percentage (payout rate) of the trust’s value. The unitrust must be revalued, and the income beneficiary distributions recalculated, at least annually. The amount paid from a standard unitrust does not depend on the amount, or type, of income earned by the trust investments. These trusts are used where cash or readily marketable securities are transferred into the trust by the donor.

2.2B) Net Income Unitrusts

A net income unitrust is an arrangement where the amount distributed to the beneficiaries is the lessor of (1) the payout rate applied to the trust’s assets computed at least annually (percent limitation), or (2) the distributable trust income for the calendar year. The unitrust agreement will specify the payout rate and define distributable trust income. The net income unitrust agreement may include a makeup provision that takes into consideration the cumulative shortfall, or the amount by which the prior years’ percent limitations exceeded the distributable trust income. The cumulative shortfall is added to the current year’s percent limitation to determine the maximum amount payable to the beneficiaries subject to the current year’s distributable trust income.

Net income unitrusts present additional issues and opportunities. Since distributions are limited to distributable income and the trust can define distributable income, the donor is given more tools to deal with their unique circumstances. Funding a unitrust with unmarketable securities would present a liquidity problem in making the beneficiary distributions. Also, the donor may not want the trust to make beneficiary distributions until some later date as in a retirement plan equivalent.

Distributable income could include only interest, dividends, rents, and royalties received by unitrust investments. This would solve the liquidity problem of unmarketable assets since the beneficiary distributions would be limited to the liquid assets received as interest, dividends, rents, and royalties. Equities and their low dividends could satisfy the retirement plan motive in the early years of the unitrust followed by a movement into bonds thereby increasing the distributable income paid to the beneficiary in the later years of the unitrust when the beneficiary’s other sources of income may be diminishing.

2.2C) Flip Unitrusts

A flip unitrust is an arrangement that begins as a net income unitrust then converts (flips) to a standard unitrust at a pre-determined time or upon the occurrence of an event, such as the sale of unmarketable securities.

Flip unitrusts eliminate the burden of earning the right type of income at the right time after the reasons for the net income limitation no longer exist. A flip unitrust could be created that drops the net income limitation and converts to a standard unitrust when the unmarketable assets are sold or when the beneficiary reaches a certain age.

3) Charitable Lead Trusts

In a charitable lead trust, the periodic beneficiary distributions (income interest) are made to a charity and whatever remains in the trust upon its termination (remainder interest) goes to a noncharitable beneficiary such as the donor, the donor’s family, or a noncharitable trust. This is a mirror image of the charitable remainder trust where a noncharitable beneficiary holds the income interest and a charity holds the remainder interest. The lead trust income beneficiary payments to charity can be fixed in amount, as in a charitable lead annuity trust, or vary each year based on the trust’s market value, as in a charitable lead unitrust.

In a grantor charitable lead trust, the donor (or spouse) receives whatever remains in the trust when it terminates. In a non-grantor charitable lead trust, a noncharitable beneficiary other than the donor (or spouse) receives whatever remains in the trust when it terminates. The assets remaining when a non-grantor charitable lead trust terminates are often given to a member of the donor’s family as in a “Family Lead Trust.”

Charitable lead trusts are complicated arrangements and should only be entered into after consulting with a professional. This article is only meant to introduce the world of charitable lead trusts and does not provide an exhaustive explanation of the tax rules and other considerations that may be encountered in this area. Charitable lead trusts are, however, generating more interest as the IRS discount rate enters historically low levels resulting in historically high present value estimates of the charitable income interest.

"It takes careful consideration to determine which methods will be of the greatest benefit to both you and the charity whose mission you want to support."

The vehicles for irrevocable deferred gifts are varied and nuanced. It takes careful consideration to determine which methods will be of the greatest benefit to both you and the charity whose mission you want to support. If you are interested in giving—or reevaluating your gifting strategy—your investment counselor would welcome a conversation to consider your options.

Download Article: Planned Giving Tools for Meeting Your Philanthropic Goals

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.