A New High in Gift Annuity Rates

With payout rates higher than they have been in more than a decade, and possible interest rate cuts on the horizon, now is an opportune time to consider establishing a charitable gift annuity.

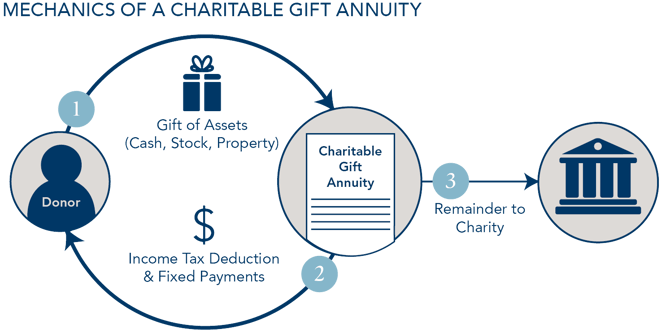

As we’ve said in previous articles, charitable gift annuities can be a great option for donors seeking an income stream. The mechanics are simple – give to a charity and receive a onetime federal income tax deduction and fixed lifetime payments. A charitable gift annuity is a contract under which a 501(c)(3) qualified public charity, in return for an irrevocable transfer of cash or other property, commits to make lifetime payments to the annuitant(s). There can be up to two annuitants, and payments can be made to them jointly or successively. The charity determines the payout amount at the time of the gift. Most charities use the payout rates recommended by the American Council on Gift Annuities (ACGA).

<br>

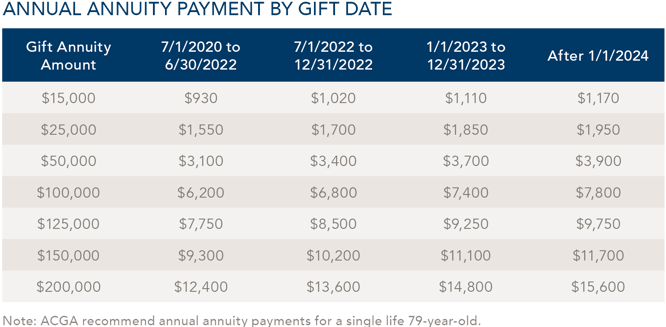

The key variables behind ACGA-recommended annuity payout rates are investment return assumptions and actuarial factors, resulting in payout rates increasing with annuitant age. The ACGA’s suggested maximum charitable gift annuity rates are designed to provide a target gift for the charity at the conclusion of the contract equal to 50% of the funds contributed for the annuity, fulfilling the donor’s charitable intent.

The American Council on Gift Annuities has raised its recommended payout rates three times in the last 18 months – in July 2022, January 2023, and January 2024. The single life suggested maximum gift annuity rate for a 79-year-old now stands at 7.8%.

These rate increases reflect updates to the ACGA’s gross investment return assumption, which most recently increased to 5.75% from 5.25%. This is in line with the Federal Reserve aggressively raising the federal funds rate (the interest rate that banks charge each other to borrow or lend excess reserves overnight, and which impacts short-term interest rates throughout the economy) from 0.25% in March 2022 to 5.50% in July 2023.

With the Federal Reserve looking to start cutting interest rates, now could be a timely opportunity to lock in higher charitable gift annuity payout rates. The 10-year U.S. Treasury yield most recently showed a decline and may be a harbinger of the Fed’s upcoming interest rate activity.

“With the Federal Reserve looking to start cutting interest rates, now could be a timely opportunity to lock in higher charitable gift annuity payout rates.”

Beyond the benefits of relatively higher charitable gift annuity rates, you can make a once-in-a-lifetime qualified charitable distribution of up to $53,000 (increased from $50,000 prior to January 2024) from your individual retirement account (IRA) to fund a gift annuity. The benefits are twofold. This tax-free withdrawal can go towards meeting the required minimum distribution for the donor’s IRA and fund an income stream.

Your investment counselor would be happy to help you design a giving strategy that coordinates your philanthropic and financial goals.

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.