Every year income taxpayers need to decide between taking the standard deduction or itemizing. For those that itemize deductions, a strategy to combine two years’ worth of charitable giving into one year has been a financial planning consideration for years. The Tax Cuts and Jobs Act (TCJA) of 2017 made this strategy even more relevant. While many TCJA tax changes are set to expire at the end of 2025, calendar-based gifting management1 may make sense for 2023 through 2025.

The Tax Cuts and Jobs Act enacted some of the most significant tax changes in the last 30 years. One of the most notable changes was to raise the standard deduction for those who don’t itemize from $12,700 to $24,000 for married couples filing jointly (and from $6,350 to $12,000 for individuals). Coinciding with this were reductions in certain itemized deductions – but not charitable contributions.

”One of the most notable [tax law] changes was to raise the standard deduction for those who don’t itemize from $12,700 to $24,000 for married couples..."

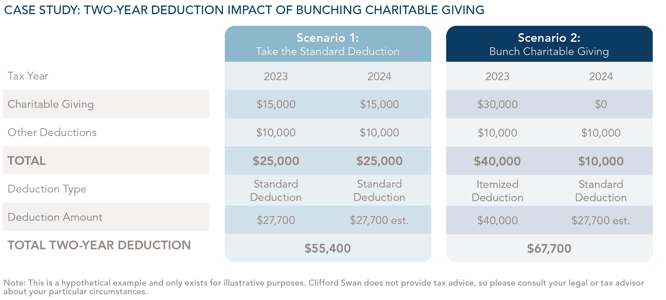

Based on inflation metrics, the standard deduction for spouses filing jointly for 2023 has increased to $27,700. To illustrate the tax impact of concentrating charitable contributions, we will use Mike and Mary as an example. Mary and Mike typically gift $15,000 each year to charities and their non-philanthropic deductions total $10,000 per year. The two scenarios below show the two-year total deduction impact of bunching their giving.

As you can see, if Mike and Mary give their desired amount of $15,000, they can have the same charitable impact but a more attractive tax situation by bunching two years of gifting ($30,000) into one year. Depending on their other deductions, this could benefit them with an additional $12,300 in deductions. This would be worth $4,305 of cash benefits at a 35% tax level.

"The same tax-smart approach can be applied to elective (planned) medical costs."

The same tax-smart approach can be applied to elective (planned) medical costs. Medical expenses that are not reimbursed and are above 7.5% of adjusted gross income can be itemized. Of course, medical procedures require more scheduling considerations than tax implications. If scheduling large medical procedures in the same calendar year is logistically realistic, concentrating medical expenses along with charitable deductions in one year and taking the standard deduction in the “off year” could result in an optimal two-year tax situation.

1Beyond the timing of charitable giving, gifting appreciated stock is almost always a better strategy than gifting cash (subject to certain limitations) and should be reviewed with a qualified tax professional.

Download Article: Tax Benefits of "Bunching" Charitable Giving

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.