August 25, 2023

Financial markets can catch investors off guard. This year has been a case study of how market rallies can occur in the face of seemingly bad news. Domestic equities roared higher in the first seven months of 2023, with the S&P 500 up more than 19% from the start of the year, while the tech-heavy NASDAQ rose an incredible 44% through the end of July. Given an increasingly challenging macroeconomic backdrop, this impressive performance was far from expected.

This disconnect is unsettling. While investing can be an emotional ride, keeping calm and sticking to an investment strategy that supports your financial plan is the key to success. Even when price actions in markets don’t make sense, a thoughtful plan should provide the flexibility needed to weather any environment.

"...a thoughtful plan should provide the flexibility needed to weather any environment."

Entering the year, several factors contributed to the uncertain backdrop, many of which persist today.

RATE HIKES AND INVERTED YIELD CURVE

As recently as the first quarter of 2022, the U.S. Federal Reserve was holding the federal funds rate at around zero and buying billions of dollars of bonds every month to boost the economy. When the central bank decided to change course and respond to inflation that was registering 40-year highs, it did so forcefully. Over the past 16 months, the Fed has raised the fed funds rate by over five percentage points. Theoretically, increasing interest rates helps to stabilize prices by putting the brakes on the economy.

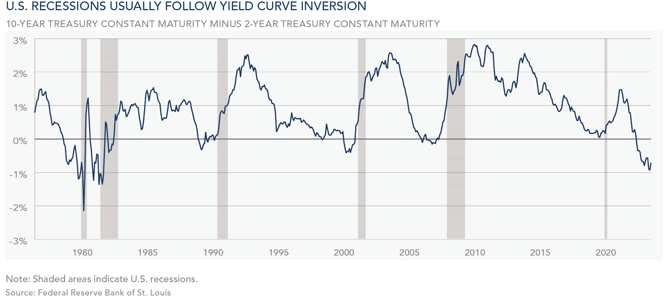

As short-term interest rates rose quickly, they surpassed the level of long-term rates – a phenomenon known as an inverted yield curve. Historically, an inverted yield curve indicates that a recession is on the horizon. The chart below shows each time a yield curve inversion has occurred since 1975. Every single time, without fail, after the difference between 10-year and 2-year U.S. Treasuries has turned negative, there has ultimately been a recession, represented by the gray bars. This time around, a recession has not yet occurred.

BANK FAILURES

The Fed's rate hikes contributed to the collapse of Silicon Valley Bank and other regional banks in March of this year. These banks held U.S. Treasury bonds that decreased in value as interest rates rose (a bond’s price and yield are inversely related). Depositors got scared and withdrew their funds en masse, causing an old-fashioned run on the bank. The failure of these banks caused fear of contagion within the banking sector and the broader economy.

TECH SLOWDOWN

Technology sector valuations decreased forcefully toward the end of 2022. Many market analysts expected the multiple compression to continue. Almost all the mega capitalization technology companies such as Google and Meta enacted mass layoffs. The technology sector serves as a bellwether for the economy, and these layoffs validated negative consumer sentiment. All economic signals were flashing red from tech executives.

"The technology sector serves as a bellwether for the economy, and these layoffs validated negative consumer sentiment."

CHINA TENSIONS

The U.S. and China are engaged in an economic war over semiconductor chip manufacturing and technology. On the geopolitical scene, China-Taiwan relations are fragile as China threatens to take over control of Taiwan, where most of the world’s advanced chips are manufactured. From computers to cars, analysts fear a takeover would cause global disruption in the production of the myriad of goods containing chips.

China’s economic conditions are also uncertain. Expectations for a robust recovery to China’s economy were high after Beijing lifted strict Covid lockdowns at the end of 2022. This has not materialized. In fact, July data shows China is facing deflation. In the short term, lower prices in China can be good for the global economy, with China essentially “exporting” low prices abroad. Ultimately, however, stable China relations and economic vitality are essential to the health of the global economy.

WAR IN UKRAINE

Over one year since Russia invaded Ukraine, the war’s threats to the global economy are still a concern. This region is important for commodities such as wheat and oil. Potential disruptions in these markets had many investors unnerved. Some effects have been mitigated by targeted policy measures and initiatives. However, if Russia truly played hardball, commodity prices could increase meaningfully, depriving the world of valuable inputs. Indeed, Moscow’s recent bombing of Ukraine’s grain export routes could renew pressures on bread and other food prices.

MARKET CONCENTRATION

The market rally that started in October 2022 has pushed stock valuations to extended levels. In the first half of 2023, participation in the rally was limited, with much of the march upwards carried by the “Magnificent Seven” technology firms: Apple, Nvidia, Microsoft, Tesla, Meta, Alphabet, and Amazon. Historically, this sort of narrowness usually reverses – indeed, there are early signs that the market is becoming more evenly distributed. Investors may remember a similar time in 2000, when just a small number of companies dominated the market. Ultimately, those firms’ stock prices declined by 70% to 90%.

"...there are early signs that the market is becoming more evenly distributed."

Where do we go from here? At this juncture, it is difficult to hold a strong opinion on the direction of interest rates, inflation, corporate profits, or even stock valuations. While the worst of inflation appears to be behind us, inflationary pressures could reemerge. Historically, there has been a lag after interest rate increases and before the economy slows down. The evidence for a coming recession has been building for some time.

Psychology rules stock prices over the short term – think of momentum investing or trading in response to the news cycle. Corporate earnings growth drives stock prices higher over the long term. We expect a more challenging backdrop for stocks in the second half of 2023 or early 2024, as higher borrowing costs (interest rates) and input costs (raw goods, labor) put downward pressure on corporate margins. Management teams have been guiding analysts for a more difficult second half for corporate profits.

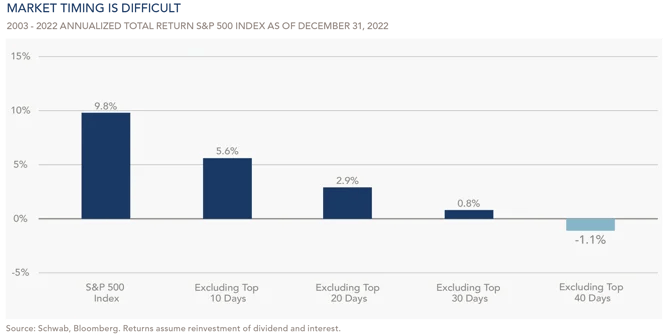

When a negative outlook for the market builds, it can be tempting to get out of the stock market to avoid a reversal of capital gains. However, market timing is inherently difficult. The chart below shows that missing just the ten best days of the market over the last 20 years would have cost investors a little over 4% per year. Not participating in the top 40 days would have lowered one’s annualized total return by almost 11%! No matter how much we want to try avoiding market declines, jumping in and out of the market is simply too risky.

Record low interest rates over the past 20 years have made asset allocation decisions difficult, with investors forced to look to riskier assets for returns. Now that yields on high-quality bonds have become competitive with stock returns, portfolio managers have more tools to meet investment objectives and, accordingly, smart allocation decisions can add value.

We advise a cautious approach that plans for an economic slowdown. This includes maintaining a conservative exposure to stocks and having an appropriate level of liquid reserves in place to meet short-term financial needs. At Clifford Swan, instead of attempting to time the market, we seek to identify high-quality companies that can emerge from various economic conditions with solid growth prospects – and to buy those companies at attractive prices. History shows that to meet long-term investment objectives, investors must be patient to let the attractive business characteristics of excellent companies accrue over time. Even under bearish scenarios, our clients’ portfolios should meet financial objectives if we stay the course.

Download Article: Staying the Course

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.