December 9, 2021

As we approach year-end, it’s natural to reflect on the investment year that was and, more importantly, consider where to find investment opportunities going forward. Given domestic stocks have performed exceptionally in 2021, investors are increasingly interested in the outlook for equity returns globally.

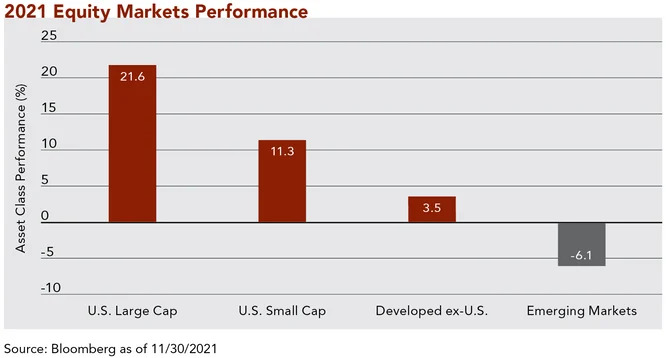

Stocks have come a long way since the depths of the Covid pandemic, particularly within the universe of the largest domestic companies. The chart below shows 2021 performance of various categories of stocks through November. U.S. large-capitalization stocks are firmly in the lead, with U.S. small-capitalization and international companies lagging. Given U.S. Large Cap is the core component of the equity portfolios Clifford Swan manages, our clients have benefitted handsomely. While we continue to see attractive investment candidates in this space, other asset classes are looking increasingly compelling.

So how did the U.S. Large Cap cohort gain such popularity, and thus experience such strong gains? A combination of strong fundamental business characteristics and a favorable macroeconomic environment drove extraordinary profits.

The five largest stocks that comprise the S&P 500 Index are all technology related – Apple, Microsoft, Meta (formerly Facebook), Alphabet (Google), and Amazon – and combined they are worth almost $10 trillion. These mega cap technology firms profited extraordinarily from Covid. Demand for their products increased dramatically as individuals used their products daily, both personally and professionally, when the world went on lockdown. This macroeconomic-driven scenario resulted in stronger business fundamentals and valuation expansion. The high levels of revenue growth and profits commanded increased investor interest and subsequently led to price-to-earnings (P/E) multiples (a measure of valuation) rising.

Beyond the demand boost Covid provided these mega companies, the Federal Reserve took extraordinary measures to prop up the economy during the pandemic, giving even more of a lift to corporate America. The Fed engaged in fiscal easing measures unseen in history, ballooning the size of their balance sheet to almost $8 trillion. By comparison, the Fed’s balance sheet was only around $2 trillion a decade ago – which was already elevated after the financial crisis of 2007-2008. One of the results of this 4x increase in the Fed’s balance sheet has been excess liquidity in the economy, and this cash found a natural home in U.S. Large Cap investment, particularly blue-chip technology stocks which dominate the indexes. On top of this, interest rates have remained extremely low during this timeframe. This scenario of “lower for longer” has exaggerated the upward move in stocks. The Fed recently committed to moderating their interventions, and this tapering process could make markets more volatile. Finally, fiscal support in the form of government stimulus checks has led to even more speculation within supposedly “safe” large-capitalized U.S. equities.

"Beyond the demand boost Covid provided these mega companies, the Federal Reserve took extraordinary measures to prop up the economy during the pandemic, giving even more of a lift to corporate America."

Given this backdrop, we believe there could be a potential shift in the marketplace. As we emerge from Covid, new market leadership may take hold. Different economic sectors or asset classes often revert to long-run mean (average) price levels after extended periods of under or overperformance. The reason for this is simple; conditions have been so perfect for so long that eventually some of the businesses that have struggled in the current environment begin to get better as well. For example, the travel and energy industries struggled during the pandemic and will likely start to return to normalcy as we emerge.

"As we emerge from Covid, new market leadership may take hold."

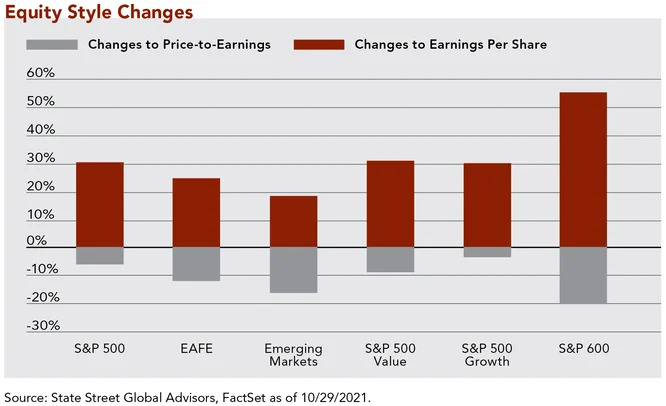

So which asset classes might provide compelling investment opportunities going forward? While we expect many large-capitalization stocks to continue to grow, we believe that international and small-capitalization stocks may play catchup to their U.S. Large Cap counterparts. Valuations in those areas are reasonable on a relative basis and, more importantly, they are expected to exhibit higher earnings growth. In the chart below, year-to-date performance is broken down into earnings growth and changes in P/E. U.S. Small Cap is represented by the S&P 600 Index, and International by the EAFE Index (Europe, Australasia, Far East) and Emerging Markets. Significant earnings growth is expected for the small-capitalization range of American stocks, yet stock prices for the asset class do not reflect this outlook. Eventually, the price multiple should play catchup and given strong fundamentals and earnings growth, we think there is now potential for relative future outperformance in Small Cap and International.

Looking more carefully at statistics, International and Small Cap are exhibiting more attractive prices relative to U.S. Large Cap across many traditional valuation metrics, including P/E, Price/Book, and Price/Sales. Over the last 15 years, these valuation metrics for U.S. Large Cap, as represented by the S&P 500 Index, are all above the 90th percentile range. Meanwhile, Small Cap and International are below the 50th percentile of their valuation ranges. These comparatively more attractive valuations support potential upside opportunity over time for investors in these currently out-of-favor asset classes. Simply put, many large domestic companies appear overvalued by investors, while small domestic and international companies are generally undervalued.

"...many large domestic companies appear overvalued by investors, while small domestic and international companies are generally undervalued."

The investment backdrop of high valuations for large domestic companies, combined with the Federal Reserve’s tapering process, suggests a rougher road ahead for some of the highflying large domestic companies. Given the macroeconomic environment, we are interested in the investment opportunities provided by International and U.S. Small Cap. To decide whether to increase portfolio allocations to these areas, we consider each client’s unique circumstances, including balancing investment time horizon against the typical investment cycle for each of these asset classes. Where appropriate, we utilize individual securities and/or mutual funds to obtain exposure to these other asset classes. Whether by choosing individual stocks or selecting funds whose managers share our same investment philosophy, our investment selections are based upon fundamental analysis of the underlying companies we own, which includes scrutinizing both valuation and quality characteristics (like the strength of a company’s balance sheet and growth potential). As events unfold, we will continue to share our observations on the markets and developing investment opportunities with you.

Download Article: Searching for Opportunity

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.