August 14, 2019

We all define "risk" to our financial well-being in very personalized ways. For some, this risk is not being healthy enough to enjoy the retirements we saved for; for others, it’s based in providing for family members who may not be able to provide for themselves; for many, it’s a fear (sometimes irrational) of running out of money during our lifetimes. For most, it’s the chance of not being able to live our lives as we hoped.

However our clients define financial risk, our work is to plan a long-term course of investment to mitigate this risk. While your investments obviously can’t solve health issues, or change family dynamics, they can be a sustainable resource to help ease these concerns and to live happily in retirement. Part of almost every conversation we have with nearly or newly retired clients is determining “how much” can be taken from investment portfolios on an annual basis to make sure the money is there when needed, and for as long as necessary.

The 4% Rule

There are several rules of thumb used by our industry to provide guidance in answering this question. Perhaps the most widely known is “the 4% rule,” originally researched and presented by Bill Bengen about 25 years ago. This rule relies on historical market returns for U.S. large cap stocks and intermediate government bonds, assuming a 60% stock/40% bond portfolio needing to last 30 years. The rule suggests that 4% of the portfolio’s value is the “safe” initial annual spending amount, increased each subsequent year by the rate of inflation. Historically, a portfolio invested in this way, with this kind of annual draw, never depleted in less than 30 years.

"...one of the greatest factors impacting the sustainability of portfolio withdrawals is the sequence of returns we experience, not the actual long-term return itself."

As the popular saying goes, however, “no plan survives its contact with reality." The future 30 years we will each experience as investors are almost guaranteed to be unlike any 30-year period that’s come before. While we may know when we are planning to retire, or have already entered that phase of our life, we have no real knowledge of how long we will live, or if historical average market returns will be what we experience in our future. In fact, one of the greatest factors impacting the sustainability of portfolio withdrawals is the sequence of returns we experience, not the actual long-term return itself.

Sequence of Returns Risk

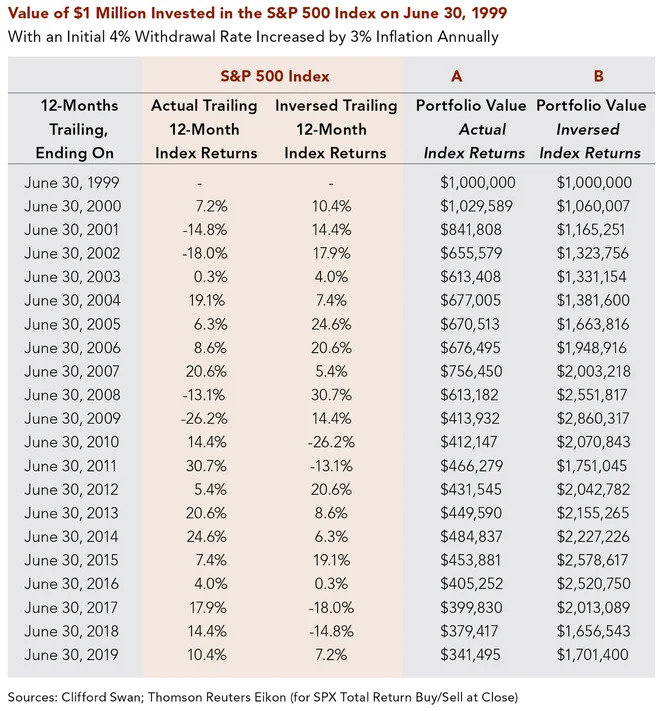

To understand what we mean by sequence of return risk, consider the table below, which describes two hypothetical $1 million all stock portfolios for two individuals who retired June 30, 1999.

The sequence of returns in Column A reflects actual returns for the S&P 500 Index for the trailing twelve months ending on the dates noted. For simplicity, assume an initial 4% withdrawal amount ($40,000) to cover retirement expenses and increase this by 3% inflation each year. These withdrawals are taken out of the portfolios before we calculated the annual returns for the portfolio. The retiree in Column B begins with the same $1 million, and 4% initial annual withdrawal, increased by 3% inflation each year. However, Column B retiree’s market returns are exactly the reverse of Column A. Twenty years later, the difference between these two portfolios is over $1.3 million. Of course, the average return for both of these portfolios over this 20-year period is identical at 7.0%.

"For distributing portfolios, the journey matters."

In general, compounding interest (interest on interest) creates the most long-term value on larger capital bases, or starting amounts. If we retire into an investment environment that initially erodes the value of our savings, we reduce our capital base at the outset, and hamper our plan moving forward. If, however, we retire into a strong market environment and our retirement savings are able to compound for several years until the inevitable bear market rears its head, then we are able to retain a larger base to sustain ourselves through the ups and downs to come. Given all this, the 4% rule, or any other rule of thumb for long-term retirement spending, may or may not be an appropriate guideline depending upon the market experience of our early retirement years. For distributing portfolios, the journey matters.

Strategies

When assessing sequence of return risk, the first place to start, always, is with the individual client’s circumstances. Not everyone is subject to this risk, and many are entering retirement with a base that requires less than a 4% draw from their investment portfolios to support their lifetime goals, and beyond. It is important to remember that the 4% rule was established as the “safe” withdrawal amount to “never” deplete a portfolio within a 30-year time frame based on historical averages. If an investor experiences a favorable sequence of returns, the ability to withdraw more than 4% in a sustainable manner may be possible.

While we have no control over the sequence of returns in the market, there are some strategies to help mitigate this risk if we are concerned about its impact over our lifespan. There are several “levers” that each of us can pull, and some combination of the strategies presented below may be appropriate for you. A conversation with your investment counselor is a great place to start.

Build Buffers into Your Spending Plan

Differentiating between our lifestyle “must-haves” and our “wants” is a sound exercise for all of us, and one that can inform how vulnerable we may be to sequence of return risk. The probability of remaining financially stable throughout our lives is reduced when we push the limits of what has to go right in order to keep the “must-haves” in place. In addition, emergency funds and appropriate insurance should be in place to guard against “what could go wrong.”

The more flexibility that can be built into a retirement spending plan, the more the retiree can take advantage of good markets while still maintaining a financial base to weather the inevitable tough times. Flexibility may come in the form of downsizing your primary residence or continuing to work part-time in retirement to reduce the initial draw on the portfolios. Turning non-income producing assets into income producing assets, such as renting a vacation home, may also be an option, even on a temporary basis.

Manage Portfolio Volatility

With stock markets at all-time highs as of this writing, sequence of return risk may be a heightened worry for those entering retirement in the near-term. This has been a long bull market and investors are understandably concerned about how much longer it can continue. The probability of having 10 more years as strong as the last 10 feels more and more remote.

"With stock markets at all-time highs as of this writing, sequence of return risk may be a heightened worry for those entering retirement in the near-term."

From an investment perspective, one technique we can use to dampen sequence of return risk is to manage portfolio volatility (the up and down swings in value). While volatility is not equal to risk when investing, it can have negative consequences in portfolios that must provide cash on a regular basis (more on this below). In the chart above, the portfolios used to illustrate sequence of return risk were invested 100% in the stock market as represented by the S&P 500. By using uncorrelated asset classes within a portfolio like this, such as fixed income, we can reduce the wide swings in returns, and therefore, the risks associated with the sequence of those returns. A portfolio designed, in this manner, to protect capital in down markets may give up some of the return in strong markets in order to preserve a larger investment base that can compound over the long term to provide steady cash flows for sustainable lifestyle spending.

At Clifford Swan, we manage portfolio volatility by diversifying our investments in asset classes appropriate to our clients' goals and time horizons, and by maintaining a strict quality discipline within each asset class we own. We expect the businesses we own to not only create wealth for us, but to do so in any economic environment by maintaining strong balance sheets, executing on their business plans, and exercising control of their destinies. Our valuation work provides an additional margin of safety, enabling us to buy great companies at reasonable prices. We expect our fixed income investments to provide stability during volatile times, preserving the purchasing power of our clients’ capital. This philosophical approach to fixed income becomes a critical piece of another technique for managing sequence of return risk in our retired clients’ portfolios.

Diversifying Your Source of Retirement Cash Flows

A corollary to “no plan survives its contact with reality,” may be that the best plans embrace flexibility. We’ve already discussed flexibility in spending, and this final strategy is about building diverse sources of cash for that spending into your plan.

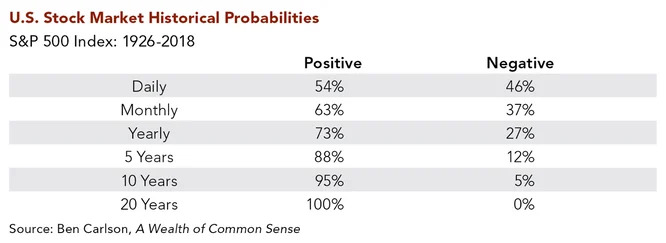

Sequence of return risk is directly related to the time frame within which cash is required from the portfolio. If you are in retirement, and you need distributions from your investments at regular intervals within the year, your investment timeframe for the assets producing that cash is very short. By contrast, if you are 20 years from retirement, the investment time horizon for the assets that will ultimately produce the cash you will need in retirement is very long. According to the chart below, the returns for the S&P 500 since 1926 were never negative, if the investment time horizon was 20 years or more. It is easy to see from this chart that if we relied only on the S&P 500 for monthly cash flows over the last 93 years, over one third of the time we would be selling stocks in a down market. Of course, this is exactly the erosion of our capital base that feeds into sequence of return risk.

By managing volatility in our portfolios through the introduction of diversified asset classes, we also introduce the concept of sources of cash that are uncorrelated to the stock market. At Clifford Swan, we call these “reserves.” The idea is that during downturns in the equity markets, assets such as bonds, which are uncorrelated to stocks, should preserve their value and can be used as a source of cash. Indeed, for retirees who may be particularly sensitive to sequence of return risk, we generally build enough reserves in their portfolios to provide retirement income for several years. These reserves allow us to protect equity portfolios from losing permanent value because we don’t become forced sellers of stocks during tough times.

Each of these strategies requires the discipline to balance your plan between: (1) controlling what can be controlled (portfolio diversification, establishing reserves); and (2) managing what needs to remain flexible (retirement spending, deployment of cash flows). What retirement looks like for you is a combination of your lifestyle, your net worth, and the future of the investment markets. With a reasonable lifestyle, a compounding base of wealth, and an “all weather” approach to managing investments, we can plan for the unknown and manage our exposure to risk.

Download Article: Risk in Retirement

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.