May 11, 2023

The cost of education has never been higher. According to the National Center for Education Statistics, the cost of education has increased by two times the inflation rate since 2000. Despite the increase in education costs, tax-advantaged 529 savings plans, which are the primary savings vehicle for education, have been underfunded by most Americans. Concerns about having leftover funds in an education account after paying for the cost of education are the primary reason for this shortfall.

"...the cost of education has increased by two times the inflation rate since 2000."

Overfunding an education plan has historically been a risk because nonqualified withdrawals from a 529 plan are generally subject to income taxes and a 10% penalty on earnings. These potential penalties have led to families hesitating, delaying, or declining to fund 529s to the levels needed to pay for the rising cost of education. Families were worried about putting too much money into the plans. What if my child gets a scholarship? What if they don’t go to college? What if my sacrifice and savings get penalized if a non-education-related withdrawal is necessary? Recent legislation helps to address these hesitations.

New Rules for 529 Plans

Secure Act 2.0 is not the sequel to last summer’s blockbuster action movie. Rather, it’s the recent law passed in December 2022 which specifically addresses the risks of overfunding a 529 plan. The law allows excess funds in 529 education plans to be rolled over into the beneficiary’s Roth IRA.

"[Secure Act 2.0] specifically addresses the risks of overfunding a 529 plan."

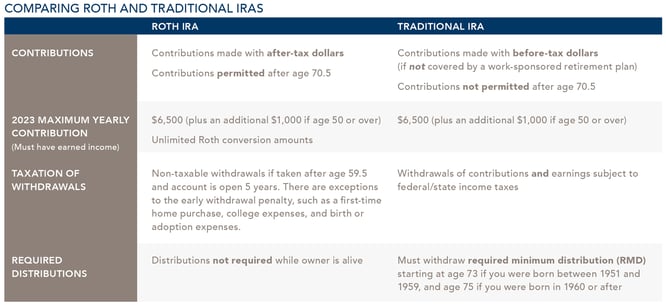

Roth IRAs offer attractive qualities compared to traditional individual retirement accounts. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning that you pay taxes on the money you contribute to the account in the year that you earn those funds. However, the contributions and any earnings grow tax-free, and you can withdraw the money tax-free in the future, as long as you meet certain requirements. Tax-free growth and tax-free withdrawals in retirement can be a huge advantage, especially if you expect your tax rate to be higher in the future. Additionally, starting a Roth IRA early, like in the case of rolled over 529 plans, provides more time for the money to compound and allows the account owner to eventually withdraw funds without giving a portion of the withdrawal to the tax man.

There are a few important restrictions to your ability to roll over funds from a 529 plan to a Roth IRA to consider:

- $35,000 lifetime cap on transfers.

- The 529 plan must have been open for 15 years or longer.

- The beneficiary must have earned income up to the amount you plan to convert to a Roth IRA.

- Rollovers can only be made to the beneficiary’s Roth IRA (not to the account owner, who is typically the parent).

- The annual limit for how much can be rolled into a Roth is the current Roth annual contribution limit, which for 2023 is $6,500.

Strategies for 529 Plans

The new ability to move 529 assets to a Roth IRA without penalties provides families with interesting planning opportunities. For example, upon the birth of a new grandchild or child, you can open and begin funding a 529 plan. The maximum annual contribution in 2023 is the same as the gift tax exemption, which is $17,000. For families seeking to reduce their taxable estate (remember that estate and gift tax exemption levels are defined by law and can change), a technique called “super funding” whereby you contribute five years’ of contributions at once ($85,000 in 2023) can be used to reduce the size of your estate and get money into an education plan while taking advantage of current gifting limits. Taking this a step further, as soon as the 529 plan beneficiary reaches 16 years old, you can begin rolling out the annual limit ($6,500 in 2023) into a Roth IRA for the beneficiary and begin the long runway of tax-free growth for the young beneficiary to draw from in retirement. The remaining funds can be allocated to education expenses. Thanks to the power of compounding over a long period, Roth IRAs can grow to significant amounts if properly invested, with the added benefit of withdrawals in retirement being tax-free.

Consider Roth Conversions Before 2025

Roth IRAs can also be a powerful tool for many of our clients that aren’t funding education. As outlined above, the cost of admission for gaining entry to tax freedom is paying the tax now. The thought of paying tax now versus later runs counter to widely held financial guidance and human instinct. But, if paying tax now allows you to prosper later, then a Roth conversion should be considered. Your investment counselor can help advise you on the key decision point between a traditional and Roth IRA which is: Will you be in a lower or higher tax rate in the future? In your conversations with your investment counselor, you can project your current and future income to determine if a Roth conversion could be right for you.

"...the cost of admission for gaining entry to tax freedom is paying the tax now."

The tax breaks established by the Tax Cuts and Jobs Act of 2017 are set to expire in December 2025. These cuts lowered taxes for many taxpayers below long-term historical averages. It’s impossible to predict future tax rates, but with a budget deficit, a slowing economy, and higher interest rates, higher future tax rates are likely. Beginning a Roth conversion plan over the next couple of years can provide you with the tax diversification options you need in the future. Without a Roth account as an option, every distribution from your tax-deferred retirement account – whether an IRA, 401(k), 403(b), 457(b), or Thrift Savings Plan – is taxable. Having the Roth option at your disposal can provide several advantages in your future retirement planning.

"It’s impossible to predict future tax rates, but with a budget deficit, a slowing economy, and higher interest rates, higher future tax rates are likely."

Let Your Money Grow

Roth IRA conversions help avoid required minimum distributions (RMDs). RMDs are mandatory withdrawals from traditional IRAs that you must take starting at age 72. For those born between January 1, 1951 and December 31, 1959, the RMD age was recently extended to 73. For those born after January 1, 1960, the RMD age was extended to age 75. The extension of the RMD age allows tax-deferred accounts to continue to grow, but with that growth comes the consequence of larger required distributions which will entail higher taxes. These required withdrawals can be a burden for some people, especially if they don't need the money. With a Roth IRA, there are no RMDs, so you can let your money continue to grow tax-free for as long as you like.

Roth IRAs as an Estate Planning Tool

A Roth IRA conversion also offers estate planning benefits. When you pass away, your beneficiaries will inherit your Roth IRA tax-free. While they are still subject to the 10-year withdrawal rule introduced by the original Secure Act, the distributions will not be taxed. This can be a huge advantage, especially if your beneficiaries are in a higher tax bracket than you were. Beneficiaries are often in their prime earnings years, so not being faced with additional taxable income is a big benefit. With the elimination of the stretch IRA (a pre-Secure Act estate planning strategy that could extend the tax-deferral benefits of an inherited IRA for generations), converting funds to a Roth for your beneficiaries will help lower taxes and provide them with tax-free money when you are gone.

"Beneficiaries are often in their prime earnings years, so not being faced with additional taxable income is a big benefit."

Your investment counselor can help you consider if a Roth conversion is appropriate for your financial situation.

Download Article: Opportunities for Maximizing Education and Retirement Accounts

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.