June 19, 2017

The stock market, as measured by the S&P 500 Index (a broad stock market proxy), has tripled in price since the depths of the financial crisis in March 2009. Since the pre-crisis market peak of October 2007, the S&P 500 is up 57% and is up 16% over the past 12 months. Over almost any extended time frame over the past nine-plus years, equity investors have experienced positive returns. During this time period there have been numerous unnerving geopolitical events, technical market scares, and constant chatter about upcoming recessions. Stocks have gyrated up and down, yet, in aggregate, the market kept climbing this “wall of worry,” and continued its upward ascent.

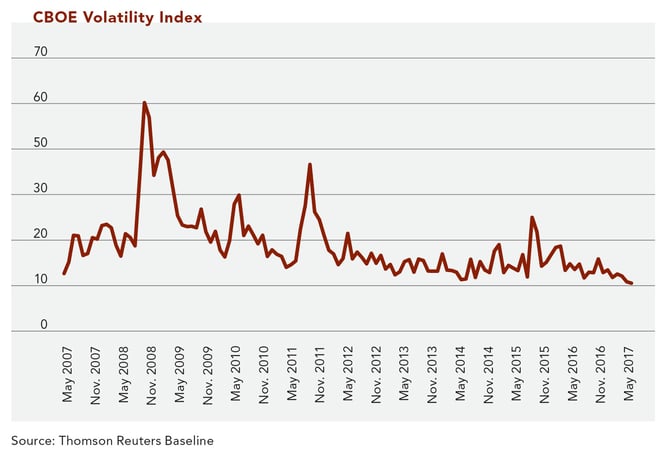

One of the most interesting aspects of the rally has been the lack of volatility. According to the Merriam-Webster dictionary, the simple definition of volatility is “characterized by or subject to rapid or unexpected change.” There has been nothing either unexpected or rapid in the markets of late. It seems that every morning the atmosphere is quiet and calm. To quantify this serenity, we turn to a measure of volatility that many investment managers utilize: the CBOE Volatility Index, or VIX. As you can see from the chart below, the VIX is trading at 10-year lows. The volatility in the first quarter of 2017 was the lowest in 50 years.1 The average absolute price change for each day in the quarter was 0.32% for the S&P 500 Index. That is the lowest average absolute percentage change for a quarter since the third quarter of 1967.

Most news has been treated as positive by the market, and although earnings reports and growth forecasts appear satisfactory, one possible reason for the tame, orderly move up is Exchange Traded Fund (ETF) investing. Certain types of ETFs are funds that are structured to mimic the indexes. As an example, an ETF that mimics the S&P 500 Index might contain all 500 stocks in the index in the same weight and proportion as they comprise the index. The biggest companies represent the greatest percentage in the fund while the smaller ones are the smallest percentages.

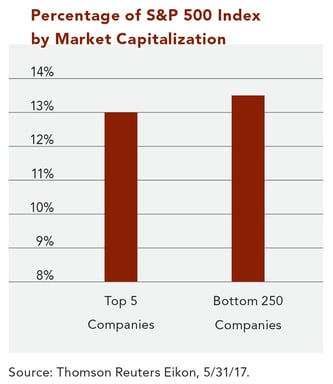

Nowadays, many investors are purchasing the index ETFs without necessarily considering the underlying components’ fundamentals and weightings. This is known as passive investing, as the investor passively buys the index with no analysis. En masse, this type of investing starts a chain reaction: monies pour into the larger companies, which results in their share prices going up, they become larger, there is more buying, their prices go up, they become larger, there is more buying, and on and on and on. As the big companies get bigger, the index slowly creeps up. This trend has led to a somewhat distorted weighting of the constituents of the S&P 500 Index as the top five component companies (Apple, Google, Microsoft, Amazon, and Facebook, respectively) are now almost equal, by market capitalization, to the bottom 250 companies combined in the index. Digest that for a second—five huge technology-oriented companies are close to equal in market capitalization to 250 companies within many varying industries serving hundreds of end markets. Keep in mind that the Information Technology sector is at the greatest risk of displacement as these companies face technological risk (obsolescence from rapid change) and that these huge weights could, therefore, be dangerous to the performance of the index.

This data is not presented as a prediction that the prices of these leading technology companies will decline but rather to illustrate that they have increased in relation to the entire marketplace. This phenomenon can continue for long periods of time until, eventually, the valuations become absurdly high and a correction occurs. The timing of this is difficult to predict.

In addition to lack of volatility due to ETF investing, the current market environment also has many underlying moving parts which we feel may be underappreciated. Although there is an appearance of strength across broad market indices, when the onion is peeled back, there is divergence within sector returns. The Energy sector has been under pressure the last several years, as have many areas of Consumer Discretionary, namely Media and Retail. On the surface, the overall market might seem like a smooth ride up, but there are lots of internal dynamics presenting opportunities to both buy and to sell.

This is when the value of active management comes into play. Active management is the process of selecting individual securities rather than passively buying the index and inherently investing in some overvalued securities. Our team of analysts is able to examine each sector and associated sub-industries to find undervalued areas of the market.

At Clifford Swan, careful due diligence and analysis is performed for each company—we know the fundamentals of each company intimately. Conversely, when investors buy a passive index there is no analysis. There is no understanding and differentiation between business models, no reading of financial statements, no discussions with management, and most importantly, no conviction in the unique investment metrics of the individual companies invested in. We buy businesses and companies that we believe will thrive in the future with lower risk. An index ETF is simply a piece of paper representing a collection of stock certificates. This is an investment in the overall trend of an index— the individual destiny of each company is not considered.

As markets rise for prolonged periods of time, speculation increases and ETF investing provides easy returns. There is no need to conduct any fundamental investigation—the index may go up in a systematic manner with seemingly no worries. Unfortunately, we think this game cannot end well. Market cycles are unavoidable; eventually, there is a market downturn and the index starts to sell off rapidly. While active management allows investors to react on the individual company level to a downturn, ETF investing, by definition, does not accommodate investing on the individual company level—the overall trend of the index is one and the same as an investor’s return.

There has not been a prolonged market downturn in quite some time. One of our primary goals is preservation of capital during market cycles, which inevitably include downturns. When the next downturn hits, we expect our clients to be well-positioned relative to passive investors. CSIC companies are some of the strongest, most stable, cash generative firms in the marketplace and are purchased at reasonable valuations. Combined with an appropriate asset allocation (see the article by my partner, Lloyd Wong), we aim to protect capital and grow it over the long term. We can tell you what you own and why you own it. We have done the fundamental work and are confident in our due diligence process.

1. Kim, Crystal, "The Least Volatile Quarter on Record Since the 1960s." Barrons.com 31 March 2017.

Download Article: Market Outlook