Faith Seeking Understanding

“The real trouble with this world of ours is not that it is an unreasonable world, nor that it is a reasonable one. The commonest kind of trouble is that it is nearly reasonable, but not quite. Life is not an illogicality; yet it is a trap for logicians. It looks just a little more mathematical and regular than it is; its exactitude is obvious, but its inexactitude is hidden; its wildness lies in wait.” —G. K. Chesterton

When in bear markets, like we are now, clients often ask us how we can keep our heads when it appears the world is coming apart. What knowledge do we possess that imbues us with the confidence to act? How are we able to make sound decisions when the range of opinions and outcomes seems incredibly wide and there is so much uncertainty? We will try to answer these questions in the ensuing paragraphs.

As of November 4, 2022, the U.S. stock market is still mired in a bear market that began at the start of the year. The S&P 500 Index peaked on January 4, 2022, at 4,819 and currently trades at 3,771, a decline of nearly -22%. The even more tech-heavy NASDAQ Index is down -33% year-to-date, while the Russell 2000 Index of smaller-sized companies is off -20% for the year.

In modern times (since 1950), bear markets tend to come in two varieties, as defined by their duration. Cyclical bear markets often occur in response to unanticipated news or events and typically last six to nine months. Secular bear markets are longer in length, lasting anywhere from 10 months to around two years, and are driven by more systemic forces. We are 10 months into the current bear market. Both the bursting of the 1990s dot-com bubble in 2000 and the Great Financial Crisis in 2008 came with secular bear markets. Conversely, the market crash in October 1987 and the 2020 Covid lockdown bear market are considered cyclical. In the last quarter of 2018, the S&P 500 Index declined almost -25%. Including that market correction as a bear market, investors have experienced three bear markets in stocks over the last four years. That is quite a bit of tumult over a relatively short period. No wonder investors are frazzled. Interestingly, however, over the last four years the average annual total return for the S&P 500 Index has been about 10%, which is very close to the long-term average return for stocks. A hard-earned 10%, for sure.

“Secular bear markets are almost always caused by an economy’s central bank tightening financial conditions, as is the case today.”

Secular bear markets are almost always caused by an economy’s central bank tightening financial conditions, as is the case today. The Federal Reserve usually announces the purpose of raising interest rates is to mute consumer demand and business investment to slow economic growth and control inflation. Another purpose may also be to try to moderate the speculative activities in the financial and real estate markets. As we are now experiencing, the Fed usually succeeds in slowing consumer demand for a period, bringing down the rate of inflation and pushing the economy into recession.

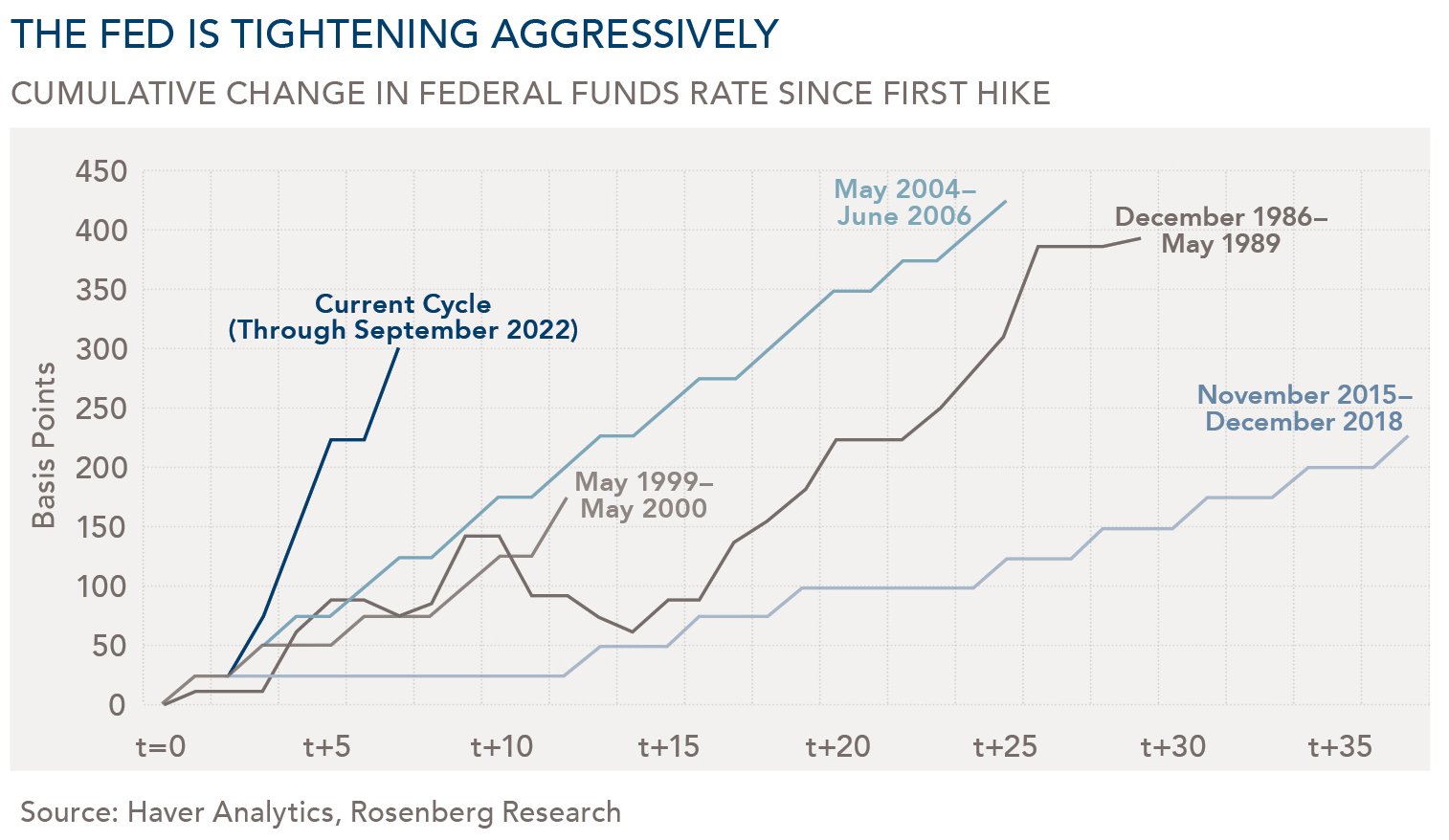

“In the current tightening cycle, which began in March 2022, the Fed has increased interest rates at the fastest pace on record.”

In the current tightening cycle, which began in March 2022, the Fed has increased interest rates at the fastest pace on record (see the chart below). The rapid rise in rates may be due, in part, to the beginning level of interest rates starting at near 0% and that inflation has been running “hotter” than the Fed predicted. The markets are forecasting that the Fed could raise short-term rates to close to 5% by next year. We are not far away from that level; at the beginning of November, the central bank raised the federal funds rate from about 3.25% to 4%. The Fed may be playing catch-up, as there are several indications that inflation pressures are already ebbing. At present, long-term inflation expectations remain well anchored, supply chains are normalizing, import prices are declining, money growth has slowed, producer price indicators in the U.S. and China have topped out, energy prices have stabilized, small businesses are reporting less pricing pressures, retail inventories are bloated, and, decisively, real estate prices have turned over in response to higher mortgage rates.

The U.S. economy grew at a solid pace in the third quarter (+2.6% GDP) and there is a fair chance that the previous quarter’s decrease in growth will be revised upward in coming reports. Still, given the Federal Reserve’s successful track record of inducing recession through tight money policies, investors are at variance as to how severe the anticipated recession will be and when it might befall us. Along with these top-of-mind questions, investors wonder if this recession will reduce inflationary pressures in the economy or if we are due for a period of stagflation. Moreover, each day, investors’ opinions clash over whether the Fed will pivot and cut interest rates in response to signs of weaker economic conditions. Similarly, our clients want to know what we know about these and other issues. Will the economy go into recession next year? Will the recession be as bad as the Great Financial Crisis? Could it be worse? Where will the rate of inflation be in 12 months, in 24 months? How low will the Fed take short rates if they reverse course, and what will the structure of the yield curve look like in 2023? What will stock market returns be in the face of a potential recession? When will the war in Ukraine end? Is China going to attack Taiwan? Fair questions, all, and we humbly submit that we do not know the answers to any of them.

“…given the Federal Reserve’s successful track record of inducing recession through tight money policies, investors are at variance as to how severe the anticipated recession will be and when it might befall us.”

Over the years we have been fortunate to have read many of the letters produced by Howard Marks. Mr. Marks is a highly regarded investor and writer for the investment community. Recently, Mr. Marks wrote a piece titled “The Illusion of Knowledge,” in which he expressed the view that pundits and investors struggling to make accurate predictions (see the questions and quote above) are fooling themselves that the future is knowable, and that no one can consistently gain a knowledge advantage by making this effort. In fact, by submitting to this illusion of knowledge, investors potentially impede their ability to make sound investment decisions. Accordingly, if we agree with Mr. Marks that attempting to forecast these key macroeconomic factors is not too helpful, it would be fair to ask what we are trying to know.

“In fact, by submitting to this illusion of knowledge, investors potentially impede their ability to make sound investment decisions.”

In the parlance of investment management styles, Clifford Swan would be described as a bottom-up manager, and this descriptive term provides clues as to what we are attempting to know. Investors who rely on forecasting interest rates, economic growth, inflation, politics, and geopolitics to make investment decisions are typically called top-down or macro managers.

Much of the knowledge we seek is a kind of recollection. Like Socrates, we work hard to know ourselves. We employ a time-tested investment style which incorporates processes and strict disciplines to aid us in making sound investment decisions appropriate to our style and our clients’ unique investment objectives. We remain humble in these efforts and try not to overestimate our capabilities. We are keen observers of history, of the financial markets, successful investment managers, and our own decision-making, understanding these normally reliable sources of knowledge are valuable – but also recognizing that this time really can be different. We gain knowledge by continuously challenging our assumptions and by viewing our decisions from multiple perspectives. This purposeful effort toward self-reflection truly helps us keep our heads during times of elevated uncertainty and to improve our investment decision-making processes over time.

“As bottom-up investment managers, we attempt to control risk at the security level and, so, spend most of our time trying to learn more about the businesses and organizations our clients invest in or lend to.”

As bottom-up investment managers, we attempt to control risk at the security level and, so, spend most of our time trying to learn more about the businesses and organizations our clients invest in or lend to. It is not that we ignore the macroeconomic trends that others key in on. Quite frankly, it is not possible or prudent to completely ignore this data. Rather, most of our investment decisions are dependent on the knowledge we obtain about the companies and industries that we study carefully. We look for specific qualities in businesses and management teams, and we gain valuable insights utilizing this process, ultimately leading to our judgment on whether this knowledge is reliable.

“When investing, uncertainty will always be a problem to solve.”

Specific to bear markets, our experiences have produced some useful insights. When investing, uncertainty will always be a problem to solve. Doubt never goes away, but it does feel more intense in bear markets. Moreover, we recognize that the natural human reaction to uncertainty, whether investing in or managing a business, is to defer making decisions until the fog of uncertainty clears. This disposition may or may not be advantageous to future results. Successful investors rely upon dependable, proven processes to gain the advantage. Also, we believe that the universe of truly long-term investors has been shrinking for some time and that this can be a tremendous advantage to those investors that can make sound investment decisions using a longer-term investment orientation. Finally, we know that lost capital is more difficult to earn back. An investment style, well-executed, that focuses on capital preservation should prevail in both bull and bear markets.

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.