March 27, 2018

“Today is the oldest you’ve ever been, and the youngest you’ll ever be again.” —Eleanor Roosevelt

Much has been written and said about our aging population, about the retirement of boomers, and about the fact that many of us are living longer than generations that came before. According to the U.S. Census Bureau, residents age 65 and over grew from 35.0 million in 2000 to 49.2 million in 2016, accounting for 12.4 percent and 15.2 percent of the total population, respectively. Boomers began turning 65 in 2011, and will continue to retire in large numbers as time goes on1. The Social Security Administration’s website calculates that a man reaching age 65 today can expect to live, on average, until age 84.3, and a woman turning age 65 today can expect to live, on average, until age 86.62. Those are just averages. About one out of every four 65-year-olds today will live past age 90, and one out of 10 will live past age 95.

Unfortunately, these statistics are not lost on another class of people—those who would prey on the aging or the cognitively impaired. As a firm that is dedicated to the financial well-being of our clients, financial elder abuse is of particular, acute concern to us. We hope this article will inform our readers regarding the many forms of financial abuse and encourage all to take preventative action before it happens.

Who Is At Risk

"...almost 37% of all seniors are affected by financial abuse within any five year period."

According to The True Link Report on Elder Financial Abuse published in 20153, almost 37% of all seniors are affected by financial abuse within any five year period. And of those affected, more than 40% shared that the costs were not just financial, with many suffering from depression, anxiety and loss of independence as a result of this abuse. While the study found that, not surprisingly, cognitive impairment had a high correlation to financial abuse amongst the respondents, it also discovered three additional correlated characteristics: friendliness, education, and financial sophistication. Specifically, the research indicates that friendliness may increase exposure to predators and the likelihood of abuse (the “friendly grandma syndrome”), while being financially sophisticated and well educated might give seniors a sense of complacency that actually increases their vulnerability. According to the True Link study, there is no strong correlation between gender or marital status and the likelihood of becoming a victim of financial abuse, but older adults with independent, active lifestyles “have more to be concerned about because they inadvertently provide perpetrators with more ways to target them.”

Types of Financial Abuse

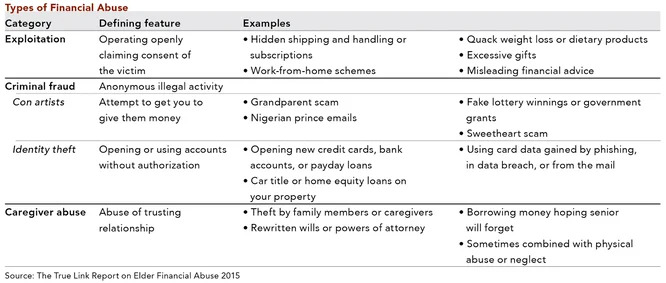

The first step in prevention is awareness. There are many different categories of financial abuse ranging from outright criminal behavior to clever exploitation within legal bounds. The perpetrators are similarly diverse, from strangers, to hired help, to family members. If we break down the types of abuse by the offenders, the following table provides a good summary.

The largest category by annual cost, according to the True Link 2015 report, is Exploitation, accounting for over 46% of all dollars lost annually. Identity Theft, a crime that has a much greater share of the national headline news, has the smallest financial impact of the categories listed in the summary above, accounting for only 8% of annual dollars lost. Con Artists and Caregiver Abuse are responsible for 27% and 19% of annual losses, respectively.

What You Can Do

"Who amongst us has not received a phone call or email asking for contributions to a charity that sounds illegitimate, or warning us that we owe money to the IRS, or pretending to be a loved one in trouble?"

The examples provided in each category of the table above may sound familiar to many of us. Who amongst us has not received a phone call or email asking for contributions to a charity that sounds illegitimate, or warning us that we owe money to the IRS, or pretending to be a loved one in trouble? To reduce our vulnerability to this onslaught, there are several rules of thumb to keep in mind:

- Remove your phone number from solicitation lists by registering at www.donotcall.gov/.

- Never give personal or financial information over the phone, or via email, especially if the call or email contact was not initiated by you. Ask for the caller to send information in writing, and for a number where you can contact the organization for verification.

- Identify a Trusted Contact who has your best interests at heart and can be another set of eyes on any offers or paperwork you are considering. Consider a select group of contacts who might fill this role, and keep them in the loop regarding your financial life.

- Do not sign anything without reading it carefully, and never be in a rush or feel pressured to close a “deal.” Take the time to have your Trusted Contact(s) review any contracts.

- Recognizing that there may be a time when you become more vulnerable to elder abuse, register your Trusted Contact(s) with each of your financial organizations as someone who may be contacted if these organizations suspect suspicious activity.

- Consider establishing a Durable Financial Power of Attorney which will allow someone you trust to manage your financial affairs in the event you become incapacitated.

- Organize important documents and review with your Trusted Contact(s) or Durable Financial Power of Attorney as necessary.

What Clifford Swan Can Do

One of the great rewards of our work at Clifford Swan is the deep relationships we build with our clients. We are in a privileged position of getting to know you over time, recognizing your financial habits and typical transaction patterns. If we see unusual activity or behavior, we will reach out to you for clarification. In the case of elder abuse, this communication may lead to further suspicions and the need to reach out to a previously identified Trusted Contact. If you have not already done so, please talk to your investment counselor about sharing your Trusted Contact information with our firm. As fiduciaries, we are mandated reporters and will contact the appropriate agencies, including the police and Adult Protective Services on our clients’ behalf if we suspect financial elder abuse.

"...some simple contingency plans, and an increased awareness of the ways in which we are vulnerable to this abuse, should go a long way toward protecting us when we need it most."

Finally, there are many resources for support, intervention and recourse on the internet. Great places to start are the websites for, or by calling, the National Adult Protective Services Association (www.napsa-now.org/policy-advocacy/exploitation/), the National Center on Elder Abuse (www.ncea.acl.gov), and AARP. The Federal Trade Commission also lists some helpful hints regarding how to deal with phone scams and identity theft: www.consumer.ftc.gov/articles/0076-phone-scams and www.consumer.ftc.gov/features/feature-0014-identity-theft. In summary, some simple contingency plans, and an increased awareness of the ways in which we are vulnerable to this abuse, should go a long way toward protecting us when we need it most.

1. United States Census Bureau. The Nation’s Older Population is Still Growing, Census Bureau Reports. www.census.gov/newsroom/press-releases/2017/cb17-100.html. 22 June 2017.

2. Social Security Administration. Calculators: Life Expectancy. www.ssa.gov/planners/lifeexpectancy.html.

3. The True Link Report on Elder Financial Abuse 2015. www.truelinkfinancial.com/true-link-report-onelder-financial abuse-012815. 28 January 2015.

Download Article: Protecting Our Assets as We Age