August 11, 2021

Two features define the current economic and financial market backdrop. The first and most obvious is the significant increase in government involvement in both areas. Second, and as a direct result of the first, the world is awash in liquidity. By liquidity we mean that cheap money is available to almost anyone who seeks it, whether governments funding budget deficits, old-line businesses padding their balance sheets or newer businesses raising money to grow (IPOs). Businesses that might not otherwise be able to raise capital due to the risky nature of the enterprise have relatively easy access to cheap capital (junk bonds). Shell companies with no definitive business plans (SPACs – special purpose acquisition companies) are garnering funds at a breakneck pace. Margin debt is setting records and hedge fund managers are finding unique methods to invest on borrowed capital. Private equity managers are sitting on massive sums of potentially leverageable funds. Individual investors have again embraced leverage (options) to goose returns. Consumer credit is growing again as new fintech companies and the payments industry find innovative ways to encourage borrowing.

"...the world is awash in liquidity...cheap money is available to almost anyone..."

For now, complacency reigns in the financial markets as investors feel as if they may have dodged a bullet. History shows us that investors have a strong tendency to extrapolate current trends, and more critically, that this has proven to be an unreliable methodology for investment, especially at market extremes. Economic and corporate earnings growth are very strong as we bounce back from last year’s weakness. In addition, investors are confident the Federal Reserve will keep easy money policies in place for some time—meaning interest rates will remain low. Strong earnings and low interest rates are usually a good combination for equity investment.

"investors have a strong tendency to extrapolate current trends...this has proven to be an unreliable methodology for investment..."

While change is sometimes imperceptible, we know that economic and investment cycles are as natural as night following day. The poet Johann Wolfgang von Goethe observed, “Sometimes our fate resembles a fruit tree in winter. Who would think that those branches would turn green again and blossom, but we hope it, we know it.” At Clifford Swan, our investment process and our experience help us to mediate the risks associated with extrapolating trends. In a sense, extrapolation is a method which ignores the uncertain (change). In uncertain times, like today, we believe our investment process helps us raise the right questions. Successful investors have developed processes that embrace the uncertainty inherent to our practice, but never stop questioning.

Life is about trade-offs. In this article we point to a few of the trade-offs taking place related to heightened government intervention and the flood of liquidity. What might be the costs associated with the speculative trading activity and current elevated high stock prices? What are historically low bond rates telling us? Are rapidly rising single-family home prices, as well as consumer goods prices, evidence of successful Federal Reserve policies? While we will focus on the U.S., it is interesting to note that many of the same fiscal and monetary policies are being followed by countries around the globe. Easy money, low interest rates, heightened sovereign debt levels, and immense budget deficits are commonplace today. Furthermore, global central banks are as active as ever in the financial markets.

Given the heightened level of intervention taking place now, we ask whether activist governments will have the ability (or desire) to extricate themselves from aggressive fiscal stimuli and ultra-easy monetary policies. Since the Great Financial Crisis of 2008-2009, central banks have played a larger and larger role in the financial markets, especially through asset purchase programs (buying both distressed and secure assets). Last year, to remedy the economic and financial market disruptions caused by Covid lockdown policies, central banks ramped up their market activity to almost unprecedented levels, comparable only to wartime periods of the past. As a result, government debt levels, which have been growing for years, exploded higher over the last 18 months. And, as mentioned, this high level of intervention continues today. Even as economies are recovering from the lockdown conditions, governments continue to plan for aggressive fiscal stimulus while running high and persistent budget deficits. These policies now seem to have become legitimized around the world. Investors wonder whether central banks might be held hostage to governments that are simply not willing or able to curb the high levels of deficit spending. For now, it appears that the “independent” central banks have accepted the risks associated with these trade-offs: higher asset prices and potential market bubbles (bonds and stocks) versus funding budget deficits.

"Investors have become increasingly emboldened to take on risk as they surmise that the central banks may not be able to tighten monetary conditions."

The quiet flood of liquidity has engendered a disconcerting level of complacency, especially as it relates to investors seeking yield. Investors have become increasingly emboldened to take on risk as they surmise that the central banks may not be able to tighten monetary conditions. Higher interest rates on government debt would result in yet larger budget deficits, which have the potential to spiral out of control. In the U.S., besides higher prices and lower yields, there is evidence that the flood of liquidity is causing “plumbing” problems in the financial system as incentive structures evolve. The personal savings rate is running at around 10%, which is higher than levels seen before Covid lockdowns. Accordingly, bank balance sheets are bloated with deposits. Banks’ deposit-to-loan ratios are hitting record levels and money velocity (the rate of turnover of money in the system) has diminished considerably. In recent months, the U.S. Federal Reserve has stepped in to relieve congestion in the banking system by soaking up excess liquidity. Of course, that is one of the jobs of the Federal Reserve, but the level of intervention has been alarmingly high. In addition, large company (mainly big tech) balance sheets are bloated with cash, as borrowing incurred during the lockdowns turned out to be superfluous.

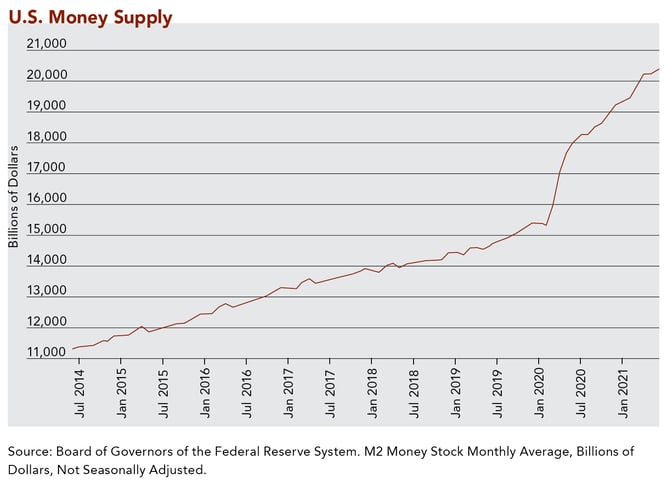

Another responsibility of the Federal Reserve is to manage the money supply. The Fed does not control the creation of all money but does manage the reserves in the banking system, which then influence the creation of money in the financial system. The U.S. Federal Reserve has two mandates: to manage for full employment and procure stable prices in the economy. Accordingly, as outlined in the Federal Reserve Act of 1913, the Fed: “shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production.” As you can see in the chart below, the money supply has been growing at a rapid pace as compared to before the lockdowns. M2, a measure of money, is up +30% over the last 18 months and is still growing at a high-teens pace. This level of money growth in the U.S. is almost unprecedented.

What is the trade-off for the implied benefits (increased production) of rapid money growth? Obviously, as more money is created the supply of U.S. Dollars becomes less scarce. The technical term for this occurrence is money debasement or devaluation. Ideally, this newly created money would cycle through the banking system wherein loans (credit aggregates) are generated for productive investment (creating jobs as well as more goods and services). But, as we mentioned, the flood of new money and congestion in the banking system indicates that the mechanisms for productive growth are not working properly. Instead, it appears that the money/liquidity is being siphoned off into other investing activities, pushing up prices in stocks, bonds, precious metals, commodities, real estate, and even cryptocurrencies. As the supply of U.S. Dollars appears to be unconstrained, it makes sense for investors to look elsewhere for relative scarcity and value.

By comparison, the supply of goods and services are relatively constrained. And because of the lockdowns, production of some goods has been curtailed. In this case, there are more U.S. Dollars chasing fewer goods, resulting in higher prices. The lockdown-induced global supply chain issues are contributing to a higher level of general price inflation. However, the supply chain issues are not the only reason for higher prices and investors are trying to understand the other factors at play.

"...there are more U.S. Dollars chasing fewer goods, resulting in higher prices."

The Federal Reserve has stated that they believe the current level of higher inflation (CPI +5%) should be transitory; this is an adequate justification for maintaining easy money policies. For now, investors seem to be accepting the Fed’s forecasts, and bond yields consequently remain subdued. If, however, inflation pressures prove to be intransigent and investors lose confidence in the Fed’s ability to control inflation, investors might call the Fed’s bluff and interest rates will move higher, especially longer-term maturities. As we mentioned earlier, this places the central banks in a difficult position as they must balance the need to fund budget deficits with the desire to keep interest rates relatively low.

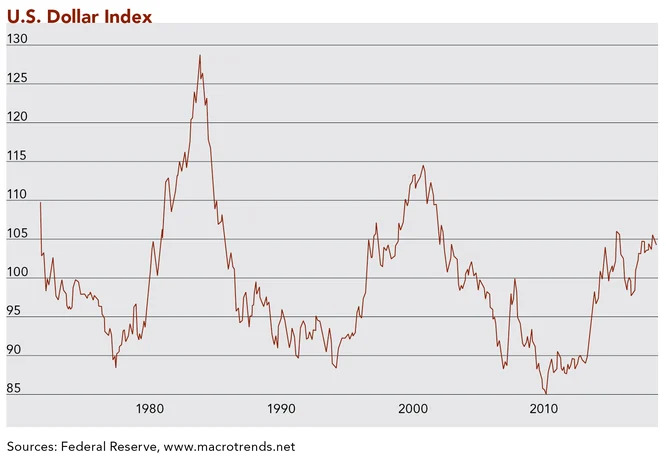

If confidence in the success of this high stakes juggling act wanes, the evidence will likely show up in the relative weakness of the U.S. Dollar against other currencies and hard assets. Please see the chart below which represents the value of the U.S. Dollar relative to the currencies of our major trading partners. As you see here, going back to the 1970’s, there have been periods of U.S. Dollar strength as well as weakness and these trends can persist for many years.

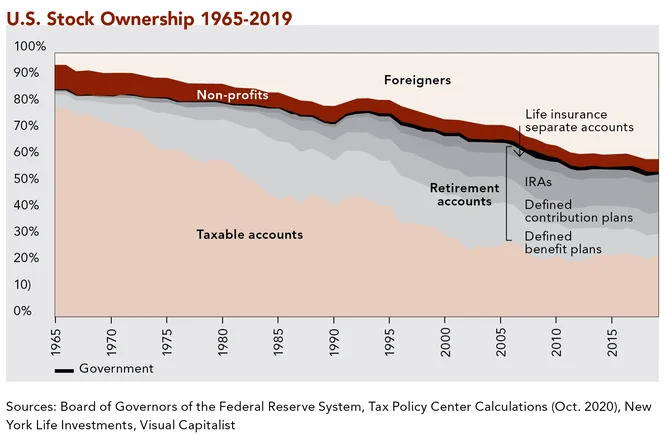

What drives these trends and why is this important? In the past, when investors (including business managers) believed a government had adopted a policy of currency debasement, they sought refuge in other currencies or other assets. Rapid money growth (less scarcity) used to fund budget deficits is the warning signal of debasement. Interestingly, as mentioned, these high stakes juggling acts are a global phenomenon today. Investors seeking refuge from currency debasement policies have few safe havens. This is likely one reason for the current popularity of cryptocurrencies, a few of which may possess some scarcity value. This global phenomenon also provides a reason for the relative stability of the U.S. Dollar over the last year (the cleanest dirty shirt). The U.S. Dollar has been quite strong since the Great Financial Crisis, attracting capital to domestic financial markets. The following chart shows the steady increase in foreign investors in U.S. stock markets.

Typically, when a currency is being debased, the offending country attempts to defend the currency by raising interest rates. In today’s world with immense budget deficits and already bloated government debt levels, raising rates will not be an easy task. Periods of currency weakness are particularly difficult to manage through. During the 1970s and early 2000s, timely and effective asset allocation decisions made all the difference for investment returns. In both periods, stock markets entered as overvalued and then, while experiencing more difficult economic conditions, the major stock markets indices stagnated for years (1968-1982, 2000-2014). For much of the 1970s higher trending inflation forced interest rates up, which also pulled down portfolio returns. However, with careful stock selection and timely deployment of liquidity into undervalued assets, positive returns after inflation were attainable.

Consistently building the purchasing power of our clients’ assets is the primary objective of our investment style. Our client portfolios are carefully constructed to be resilient through periods of inflation or disinflation. We believe our style’s primary advantages are derived from our long-term investment time horizon, a focus on high quality investments, and a disciplined approach to security selection and valuation.

"For now, the flood of liquidity is floating all boats..."

For now, the flood of liquidity is floating all boats and investors are acting as if the waters shall not recede. However, while we admit the timing is uncertain, the flood will prove transitory—like Goethe, we know it.

Download Article: Long Day's Journey into Night

The above information is for educational purposes and should not be considered a recommendation or investment advice. Investing in securities can result in loss of capital. Past performance is no guarantee of future performance.