February 5, 2016

U.S. equity market returns for 2015 were challenging, with the price of the S&P 500 Index down 0.73% over the year. With a peak to trough difference of approximately 14%, a long distance was traveled to end relatively flat. Including dividends, however, the S&P 500 Index was up 1.37%, demonstrating the importance of dividends to shareholders. The road traveled was unlike what investors have seen in recent years. Highlighted by choppy domestic equity markets and narrowing opportunities to invest in highquality undervalued companies, investors clamored for growth and yield in their portfolios. The year was driven by interest rate speculation, currency volatility, weakening commodities, and a strengthening U.S. dollar. The underlying reasons are, however, somewhat more complex as the U.S. economy experiences slower growth, lower inflation, and the prospects of modest returns carried into the New Year

"The year was driven by interest rate speculation, currency volatility, weakening commodities, and a strengthening U.S. dollar."

A durable U.S. domestic economy has been the strong leg on a shaky global stool. With the U.S. focused on tightening monetary policy and major, global developed economies, such as China, Europe, and Japan, focused on more accommodative policies, this global economic divergence became greater throughout the year and should continue into 2016. Given that many investors look for large, stable, high-quality businesses in times of uncertainty, the strength of the U.S. dollar could provide an additional hurdle as these companies typically receive a large portion of their total revenue internationally and are consequentially more exposed to foreign currency exchange impacts. As a result, the typical “flight to safety” could be different than previously experienced given the macroeconomic landscape. With more questions than answers in the global financial markets, the focus on diversification and active management should become more important themes moving forward.

With that said, the U.S. has a relatively strong domestic economy; attractive valuations in the EU and Asia could materialize into long-term opportunities as those regions have additional tools to propel growth. Deciphering the noise from the news will continue to be a theme for investment professionals moving forward. With the Federal Open Market Committee (FOMC) raising the target range for the federal funds rate by 25 basis points, the domestic equity market appears to be in somewhat unfamiliar territory.

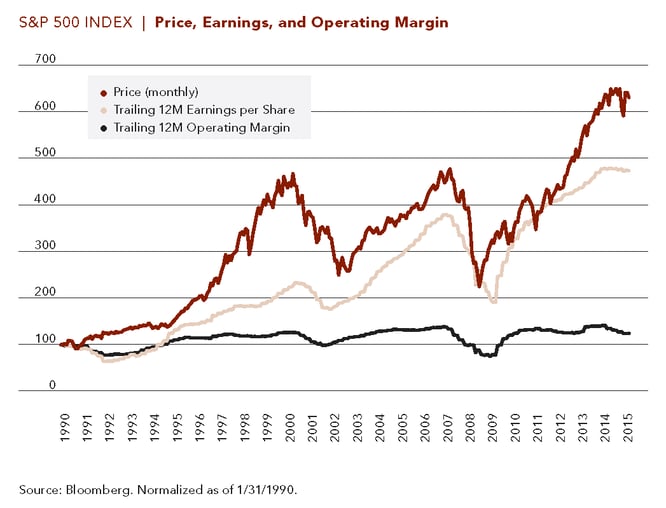

With this backdrop, Clifford Swan will continue to execute on its longstanding equity strategy of analyzing company-specific fundamentals. While a rising tide lifts all boats, the converse has also proven to be true, and our analysis of current market fundamentals leads us to believe there will be opportunities for active managers to add value through individual security selection and portfolio construction moving into 2016. The chart below depicts the monthly price movement of the S&P 500 Index (red line) against the trailing 12-month earnings (beige line) and operating margins (black line) of its constituents, since 1990. This displays a “topping” and slowing of corporate earnings growth in the broader market, as measured by the S&P 500 Index. As earnings growth has slowed, so has the broader market. This is creating an equity market inflection point.

It is important to monitor whether the market is "getting ahead of itself" based on what corporations are earning in the current environment. The spread between the S&P 500 Index against the trailing 12-month earnings of its constituents currently indicates that market prices have been expanding faster than earnings. However, when the spread becomes stretched, indicating that the market is expanding exponentially faster than the fundamental metrics, the market typically slows and contracts in subsequent periods. While this is not a perfect indicator, it is one piece of a larger, complex, valuation puzzle.

With the market indicating a possible inflection point, investors should position themselves for more volatility and lower price appreciation relative to the bull market run we have seen since the 2008 financial crisis. Now that the FOMC has provided additional clarity on the interest rate “normalization” path, one level of uncertainty has been removed in the market. News headlines typically focus on top-line (revenue) and bottom-line (earnings) growth; however, corporate margin expansion, or retraction, can be a decent indication of future growth potential as well. Given the uncertainty in the macro environment, corporations have looked to increase efficiencies, cut costs, and control company-specific items. The chart above shows the S&P 500 Index constituents reaching their highest operating margins (black line) moving into 2015. While some of this is due to technology efficiencies, which are gained over time, it is also important to realize that companies have trimmed the “low hanging fruit” available to help boost bottom-line growth; margins appear to be stretched in the broader market and are contracting moving into 2016. This could be one explanation for the slower earnings growth, along with the slowing of financial engineering fueled by inexpensive debt.

Given the fall in commodity—specifically oil—prices, the Energy and Industrial sectors experienced a challenging year in 2015. Both sectors appear to have gone through a “repricing” scenario relative to the broader market. While Energy and Industrials, as a whole, traded lower, the broader market stayed relatively flat in 2015. This is important because, while some of the companies in the Energy and Industrial sectors are beginning to look like attractive value investments, the multiple-contraction (price relative to earnings) has reset expectations relative to the broader market. If the market enters a bear market, these stocks could have more pain before they begin to turn around, especially those strongly correlated with the domestic economy. Companies that grow their businesses below the U.S. gross domestic product (GDP) rate will likely receive multiples lower than the broader market; these companies are typically cyclical and more exposed to broader market downturns.

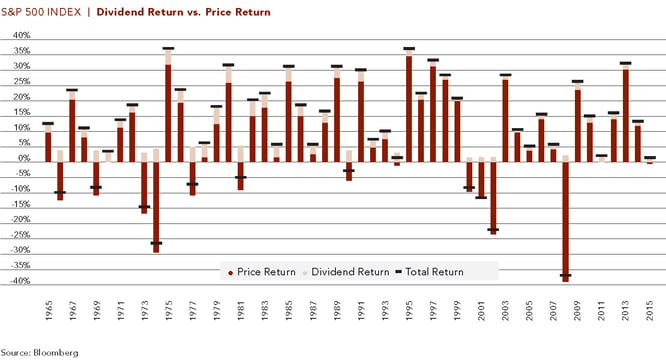

Moving into 2016, investors are very cautious. Enhanced clarity domestically will be offset by uncertainty globally. Corporate capital returns (dividends and share repurchases) will continue to play a substantial role in the long-term total return of the U.S. equity market. The chart below represents the annual calendar year returns of the S&P 500 Index over the last 50 years. What becomes evident is that the U.S. equity market is up more often than it is down. The average calendar year price return over this time period was approximately 10.9%, with up markets contributing approximately positive 15.8% and down markets contributing approximately negative 13.3%. Dividends have and should continue to be a large portion of total returns over time and can help portfolios weather weak markets. 2015 was an extraordinary year as a negative price return with a positive total return (including dividends) is quite rare; it has previously only occurred in 1994 and 2011.

While some investors place great emphasis on price return, Clifford Swan approaches portfolios from a total return perspective. The data above suggests a slowing equity market, however, these signs have been seen before. The market appears to be determining whether the U.S. equity market is simply taking a breather before its continued bull run, going through a healthy correction, or if we are moving into a broader “repricing” environment.

"Dividends have and should continue to be a large portion of total returns over time and can help portfolios weather weak markets."

During our 100 years of counseling investors, we have seen virtually every market scenario possible. While we do not time the market, we do use short-term dislocations between intrinsic value and price to take long-term positions in high-quality businesses. These companies typically have strong competitive advantages, solid balance sheets, and proven management teams. We will continue to rely on our longstanding philosophy moving into 2016 and take advantage of an anticipated volatile environment.

Download Article: 2016 Market Outlook